Sensex & Nifty likely to open on gap down on Monday as the Q4 earnings from index weight heavy Infosys and HDFC Bank reported below expectation results. Infosys earnings missed on margins front amid high attrition rate (27%) and HDFC Bank reported 10% NII growth and lowest NIM of 4%. Inflation pressures fuelling sharp rally in bond yields, sharp rise in brent crude oil prices and below par Q4 earnings could spurt volatility in markets and cap short-term gains.

In the coming week, investors will watch out for Manufacturing flash PMIs from US and Eurozone. China will release GDP growth data. Domestic investors will watch out for earnings from ACC, Tata Elxsi, HCL Tech, Nestle India, LTTS, ICICI Bank and Bajaj Finance.

Equity Market Summary:

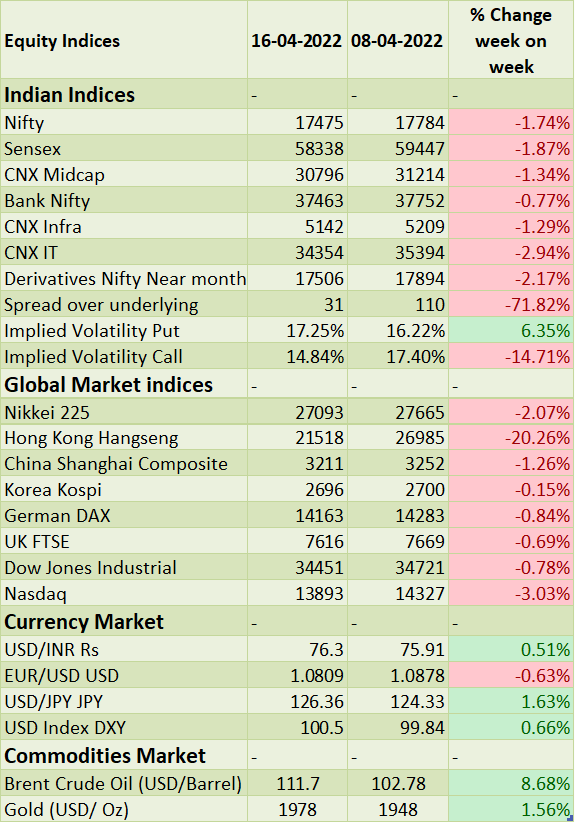

� In domestic markets FIIs/FPIs sold Rs.411 billion in March 2022 and brought Rs. 31 billion in April 2022 (as of 18th April 2022)���������� .

� ECB left interest rates unchanged during policy-meeting, central bank said it is planning to gradually cut-off monthly pandemic relief asset purchase program and followed by rate hikes.

� Equity markets in US equities closed on a negative note amid rising bond yield and lower than expected results.

� European indices closed on positive note on Thursday as investors assessed the reduction of pandemic-era monetary support from the ECB as being roughly in line with expectations

� UST closed at 2.8% just short of 3-year highs.

� Brent crude futures rose by 8% in the previous week, as lingering concerns over supplies fuelled the bullish trend. OPEC warned that Russian oil was irreplaceable, and data showed Russian oil and gas condensate production dropped to the lowest in nearly two years.

� The number of Americans filing new claims for unemployment benefits rose by 18,000 to 185,000 in the week ended 9th April 2022.