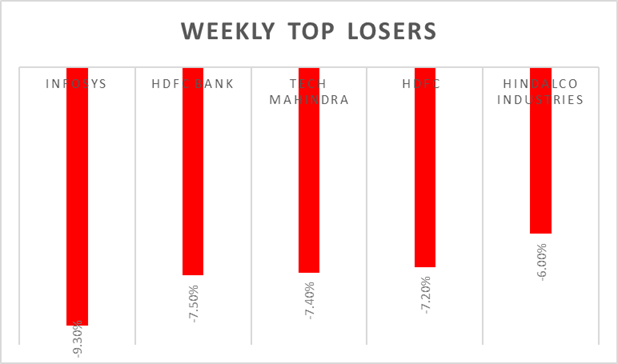

Sensex & Nifty declined 1% on Friday tracking global market cues. Equities witnessed sharp sell-off after Fed said that they are open to hike rates by 50bps in the upcoming policy-meeting. Weak earnings from Infosys and HDFC bank dampened investors sentiment leading Sensex & Nifty to close 2% lower than previous week traded levels.

In the coming week, investors will watch out for US tech stocks earnings and US & Eurozone GDP growth data. Domestic investors will watch out for earnings Bajaj Finance, Sanofi, Bajaj Auto, HUL, Ultratech and Maruti Suzuki.

Equity Market Summary:

� In domestic markets FIIs/FPIs sold Rs.411 billion in March 2022 and sold Rs. 122 billion in April 2022 (as of 25th April 2022).

� Japan's inflation rose by 1.2%(Y-o-Y) in March 2022, the most since October 2018, after a 0.9% gain a month earlier.

� The S&P Global US Services PMI fell to 54.7 levels (preliminary) in April 2022 from 58 in March, the lowest in 3 months and well below forecasts of 58 levels

� Equity markets in US & Europe closed on a bearish note amid rising bond yield and fed raising interest rates at faster pace.

� European indices closed on positive note on Thursday as investors assessed the reduction of pandemic-era monetary support from the ECB as being roughly in line with expectations

� UST closed at 2.92% at 3-year highs.

� Industrial production in the Euro Area increased 0.7% M-o-M in February 2022, rebounding from a 0.7% slump in January and matching market forecasts