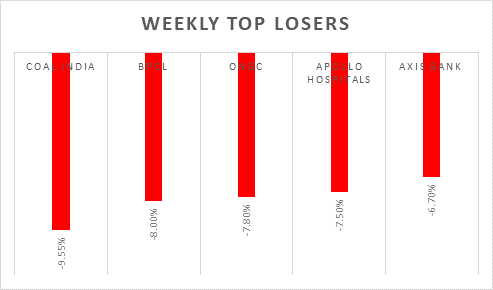

Sensex & Nifty closed 1.3% down from Friday�s high amid negative global cues. Eurozone reported highest inflation reading, US GDP growth contracted by 1.1%, expectation of Fed hiking rates by 50bps and crude oil trading above USD 100 per barrel spooked investors. Domestic Q4 earnings show margin erosion and bleak outlook due to high raw material costs. Choppy trends are likely to continue, and volatility levels would spike in the coming week.

GST collection has crossed the Rs. 1.5 trillion mark for the first time in April 2022 and the Rs 1 trillion for the 10th month in a row. GST collections for the month of April 2022 stood at Rs. 1.68 trillion.

In the coming week, investors will watch out for US job data and Fed monetary policy-meeting outcome. Domestic investors will watch out for earnings Havells, Dabur, TVS Motors, Tata power and Federal Bank.

Equity Market Summary:

� In domestic markets FIIs/FPIs sold Rs.411 billion in March 2022 and sold Rs. 171 billion in April 2022.

� US indices witnessed sharp sell off on Friday amid higher PCE reading and lower than expected GDP growth rate dented market sentiment.

� US economy contracted at an annualized 1.4% in Q1, well below market forecasts of a 1.1% expansion and following a 6.9% growth in Q4 2021.

� European stocks finished the last trading day of April on a positive note despite inflation touching record highs.

� Japan's Industrial production rose 0.3% MoM in March 2022, slowing from a 2% gain in the previous month and falling short of the 0.5% growth forecast.

� China General Manufacturing PMI fell to a 26-month low of 46 levels in April 2022 from March's reading of 48.1 levels, below market forecasts of 47 levels.

� The personal consumption expenditure price index in the US climbed 6.6% YoY in March 2022.

� Eurozone economy expanded by 0.2% on quarter in the first three months of 2022.

� The annual inflation rate in the Euro Area rose to a fresh record high of 7.5% in April 2022 from 7.4% in March 2022.

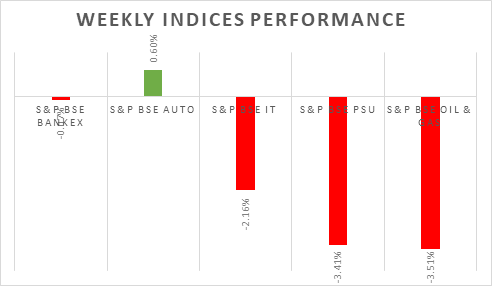

Equity Indices | 29-04-2022 | 22-04-2022 | % Change week on week |

Indian Indices | - | - | - |

Nifty | 17102 | 17171 | -0.40% |

Sensex | 57060 | 57197 | -0.24% |

CNX Midcap | 29880 | 30315 | -1.43% |

Bank Nifty | 36088 | 36044 | 0.12% |

CNX Infra | 5127 | 5197 | -1.35% |

CNX IT | 31622 | 32426 | -2.48% |

Derivatives Nifty Near month | 17133 | 17166 | -0.19% |

Spread over underlying | 31 | -5 | -720.00% |

Implied Volatility Put | 20.83% | 18.16% | 14.70% |

Implied Volatility Call | 15.86% | 14.98% | 5.87% |

Global Market indices | - | - | - |

Nikkei 225 | 26847 | 27105 | -0.95% |

Hong Kong Hangseng | 21089 | 20638 | 2.19% |

China Shanghai Composite | 3047 | 3086 | -1.26% |

Korea Kospi | 2695 | 2704 | -0.33% |

German DAX | 14098 | 14142 | -0.31% |

UK FTSE | 7544 | 7521 | 0.31% |

Dow Jones Industrial | 32977 | 33811 | -2.47% |

Nasdaq | 12334 | 12839 | -3.93% |

Currency Market | - | - | - |

USD/INR Rs | 76.52 | 76.46 | 0.08% |

EUR/USD USD | 1.0543 | 1.0794 | -2.33% |

USD/JPY JPY | 129.85 | 128.57 | 1.00% |

USD Index DXY | 103.21 | 101.12 | 2.07% |

Commodities Market | - | - | - |

Brent Crude Oil (USD/Barrel) | 107.14 | 106.5 | 0.60% |

Gold (USD/ Oz) | 1912 | 1931 | -0.98% |