Domestic markets witnessed sharp sell-off for the consecutive 2-week period. FIIs pulled out whooping amount of Rs.1523 billion (YTD) from domestic equities. Near term pain points for investors are:

1) Soaring inflation

2) Rising oil prices

3) Monetary policy tightening

4) Slowing global demand

5) Rising UST

6) Weak corporate earnings

Selling pressure likely to continue in markets despite any pullback in indices. On the macro-data front, CPI data came in at 7.79% for April 2022 highest in last 8 years. Industrial production in India grew 1.9% (Y-o-Y) in March 2022.

In the coming week, investors will watch out for Fed officials speeches which would give guidance over future rate hike pace. Japan and UK will publish inflation data. Domestic investors will watch out for domestic earnings and LIC IPO listing. On corporate deal front, Adani to buy Holcim�s stake in Ambuja Cements and ACC for USD 10.5 billion to seal largest infra and materials deal in India.

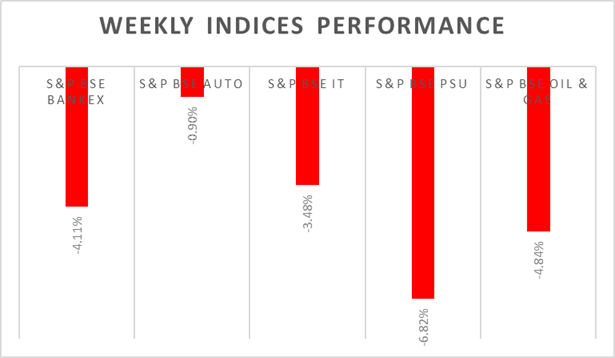

Equity Market Summary:

� In domestic markets FIIs/FPIs sold 171 billion in April 2022 and sold Rs. 252 billion in May 2022 (as of 15th May 2022).

� US indices closed on strong note, despite Friday�s gain wall street indices declined for the 6th consecutive week.

� Annual inflation rate in the US slowed to 8.3% in April 2022 from a 41-year high of 8.5% in March 2022.

� US consumer sentiment declined to 59 levels in May 2021, lowest since 2011.

� The number of Americans filing new claims for unemployment benefits increased by 1,000 to 203,000.

� Europe�s major stock indices bounced back on Friday as much as 2%, amid strong corporate earnings.

� Industrial production in the Euro Area fell 1.8% M-o-M in March 2022, the biggest fall in nearly two years.

� ECB President Lagarde said first Euro-zone hike will take place post end of asset purchase program.

� China's annual inflation rate accelerated to 2.1% in April 2022 from 1.5% in March, above market forecasts of 1.8%.