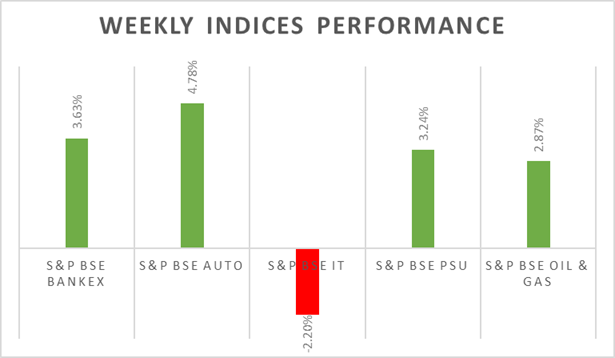

Domestic indices witnessed V shape trading pattern over last two trading days of the week. On Friday, they rallied sharply as much as 3% on the back of positive global cues due to China�s rate cut.� For the whole week, Sensex & Nifty gained by 3% snapping five weekly declines. Volatility is likely to continue due to month end F&O expiry and weak global market sentiment. LIC shares listed at discount and currently down by 15% from IPO price band.

In the coming week, investors will watch out for global PMI levels and Fed policy-meeting minutes. Q4 earnings will keep domestic investors busy and Delhivery & Pradeep phosphates will list on bourses during this week. �

Equity Market Summary:

� In domestic markets FIIs/FPIs sold 171 billion in April 2022 and sold Rs. 351 billion in May 2022 (as of 22nd May 2022).

� US indices bounced back from lows touched on Friday. However, markets remained volatile during the week amid disappointing forecasts from retailers, including Walmart and Target.

� Industrial production in the US rose 1.1% from a month earlier in April 2022.

� Number of Americans filing new claims for unemployment benefits increased by 21,000 to 218,000.

� European indices closed on positive note on Friday, however, on weekly basis indices declined.

� Latest ECB policy-meeting minutes show concerns over high inflation and agreed that a gradual normalisation of the monetary policy should continue.

� The Japanese economy shrank 0.2% QoQ in Q1 of 2022, 2nd contraction in last 9 months.

� Core consumer price index in Japan, jumped 2.1% in April 2022 from a year earlier, hitting a more than 7 year high.

� The PBoC cut its five-year loan prime rate (LPR) by 15 bps, the biggest reduction since a revamp of the rate in 2019.

� Brent crude prices stayed at same levels compared to previous week, as the investors expect oil demand from China to bounce back as Covid-19 restrictions ease.