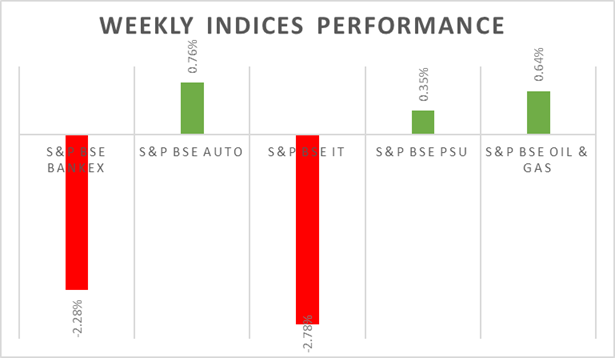

Sensex and Nifty gave up initial week gains and declined more than 2% during the week. RBI hiked rates by 50bps and raised inflation forecast to 6.7%, higher inflation forecast dampened market sentiment. Domestic equities are likely to witness spurt in volatility amid negative global cues, yield curve inversion (recession fears) and relentless FII selling pressure. US reported 4 decades high inflation growth which could push Fed to hike rates aggressively in the upcoming policy-meeting and ECB will start hiking rates by July which will be the 1st rate hike in a decade. On the domestic macro-economic data front, industrial production in India jumped 7.1% (Y-o-Y) in April 2022, advancing from an upwardly revised 2.2% rise in the previous month and beating market expectations of a 5.1%.

�In the coming week, investors will watch out for Fed, BoJ and BoE policy-meeting outcome and Fed chair press conference.� Domestic investors will keenly look out for CPI and balance of trade data.

Equity Market Summary:

� In domestic markets FIIs/FPIs sold 399 billion in May 2022 and sold Rs. 138 billion in June 2022 (as of 12th May 2022).

� US indices closed sharply lower on Friday, as the inflation data came in higher than expected. Higher inflation growth and tighter labour market could open gates for 75bps rate hike by Fed.

� Annual inflation rate in the US unexpectedly accelerated to 8.6% in May 2022, the highest since 1981 and compared to market forecasts of 8.3%.

� The trade deficit in the US narrowed to USD 87 billion in April 2022 from a record of USD 107.7 billion in March 2022 and below market forecasts of a USD 89.5 billion gap.

� Michigan consumer sentiment in the US fell sharply to a record low of 50.2 levels in June 2022, well below market forecasts of 58 levels.

� 10-year UST rallied to 3.16% amid higher inflation growth.

� European stocks closed lower on Friday, amid ECB hiking rates faster than expected and US reporting 4-decade high inflation growth.

� The ECB said during its June 2022 meeting that it will end net asset purchases under its APP as of 1st July 2022 and intends to raise the key ECB interest rates by 25 basis points in July 2022.

� China's trade surplus jumped to USD 78.76 billion in May 2022 from USD 43.28 billion in the same month a year earlier.

� China's annual inflation rate was at 2.1% in May 2022, unchanged from April's five month high figure.