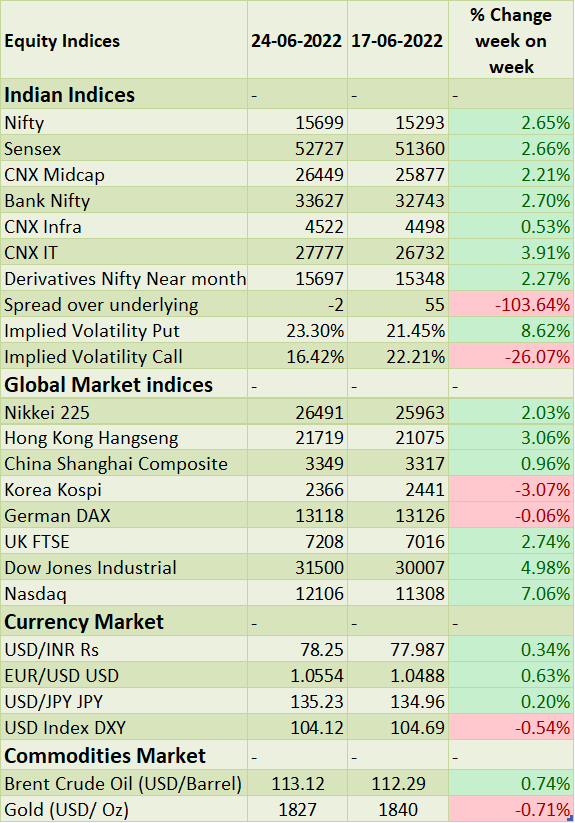

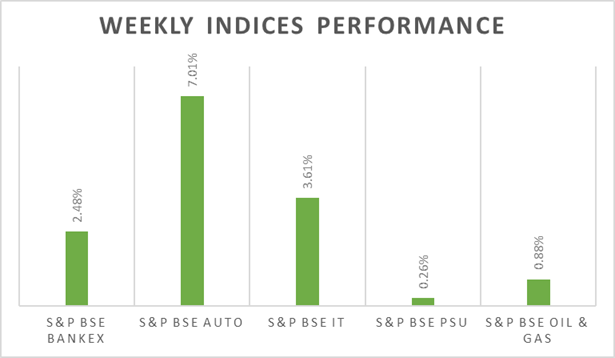

Sensex and Nifty witnessed relief rally during the week post the 3-week sharp decline. Commodity prices cooled-off from highs as the fears of recession sparked worries of declining demand for commodities. Bond yields cooled-off from multi year highs, however, yield curve is flattish which shows signs of recession risk. Domestic rainfall deficit fell to 2% LTA from 25% LTA, showing signs of revival towards the LTA.

On the macro-economic data front, CAD declined to USD 13 billion in Q4Fy22 from USD 22.2 billion in Q3Fy22. However, on yearly basis CAD expanded from USD 8 billion seen in Q4Fy21 amid sharp rise in trade deficit.

�In the coming week, investors will watch out for US GDP growth and consumer confidence data points. Speeches from Fed Chair Powell, ECB President Lagarde, and BoE Governor Bailey will be keenly watched.

Equity Market Summary:

� In domestic markets FIIs/FPIs sold 399 billion in May 2022 and sold Rs. 458 billion in June 2022 (as of 26th May 2022).

� US indices closed on positive note on Friday amid expectations of higher and faster rate hikes cooled. All 3 major indices gained by 3% and snapped 3-week declining trend.

� Fed Chair Powell acknowledged that steep interest rate hikes may cause a recession in the US, and avoiding it mostly depends on the factors beyond Fed control.

� University of Michigan survey showed that consumer sentiment hit a record low level in June and its gauge of inflation expectations over the next 5 to 10 years, fell to 3.1% from 3.3%.

� Current account deficit in the US widened to a record high of USD 291.4 billion in Q1 2022.

� S&P Global US Services PMI fell to 51.6 levels in June 2022 from 53.4 levels in May 2022, the lowest in five months and well below forecasts of 53.5 levels.

� Number of Americans filing new claims for unemployment benefits decreased by 2,000 to 229,000 in the week that ended June 2022, below market forecasts of 227,000, pointing again to a tight labor market.

� European equities finished Friday's session sharply higher, snapping two straight sessions of losses, as inflation worries receded due to this week's downturn in commodity prices.

� S&P Global Eurozone Composite PMI fell to 54.8 levels in June 2022 from 51.9 levels in May 2022, compared with the market consensus of 54 levels.

� S&P Global Eurozone Services PMI dropped to 52.8 levels in June 2022 from 56.1 levels in the previous month and compared with the market consensus of 55.5 levels.

� Annual inflation rate in the UK increased to 9.1% in May 2021 from 9% in the previous month, the highest since 1982 and in line with market expectations.

� Jibun Bank Japan Services PMI climbed to 54.2 levels in June 2022 from 52.6 levels in May 2022.

� The annual inflation rate in Japan was at 2.5% in May 2022, unchanged from April's 7-1/2-year high figure and in line with market consensus.

��

��