INR touched historic lows of Rs.80 per on a strong demand for USD, foreign fund outflows, declining foreign exchange reserves, and fast-widening trade and current account deficits. RBI has been intervening in the currency market and incorporated new measures to stem INR fall, however the efforts seem ineffective. Maybe further fall in INR would push RBI to hike rates aggressively. However, aggressive rate hikes would suck liquidity from the markets at record pace which would create sell-off in equity markets. Sensex & Nifty could see additional selling pressure due to disappointing earnings from corporates. High inflationary environment, weakening global demand and rising cost of borrowing are major headwinds for corporates.

Domestic macro-economic data front:

� Industrial production in India jumped 19.6% YoY and 2.6% MoM in May 2022

� Domestic CPI & WPI recorded at 7.01% & 15.18% respectively

� Trade deficit revised higher to USD 26.18 billion from previous estimates of USD 25.6 billion.

�In the coming week, investors will watch out for US corporate earnings and BoJ & ECB policy-meeting outcome. Q1FY23 earnings will keep domestic investors busy.

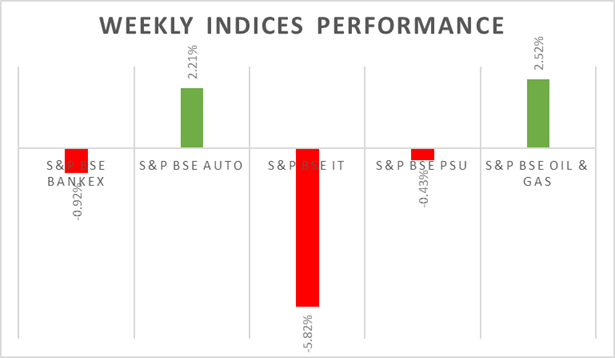

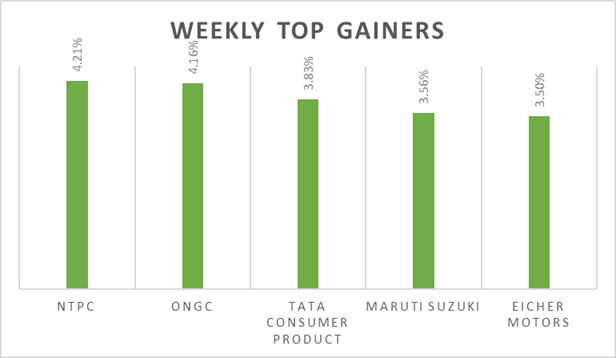

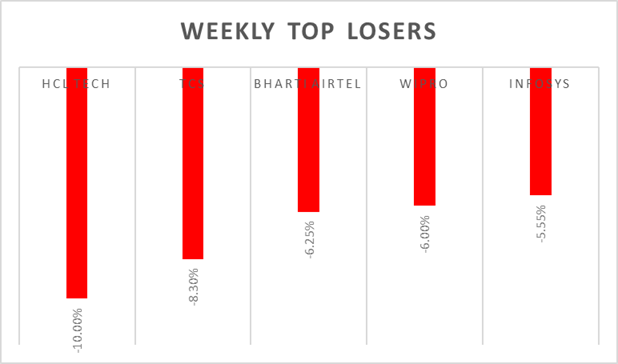

Equity Market Summary:

� In domestic markets FIIs/FPIs sold Rs. 502 billion in May 2022 and sold Rs. 74 billion in July 2022 (as of 17th July 2022).

� Wallstreet indices closed sharply higher on Friday as retail sales data and Michigan consumer confidence data came in better than expected.

� University of Michigan consumer sentiment for the US increased to 51.1 levels in July 2022 from a record low of 50 levels in June 2022.

� US CPI accelerated to 9.1% in June of 2022, the highest in 40 years.

� Manufacturing production in the US declined by 0.5% in June 2022.

� Industrial production in the US decreased 0.2% from a month earlier in June 2022, missing market expectations of a 0.1% increase.

� Euro Area recorded 7th consecutive trade deficit month, compared to a EUR 12 billion surplus a year earlier.

� Chinese economy advanced 0.4% YoY in Q2 2022, missing market consensus 1% and slowing sharply from a 4.8% growth in Q1.

� Industrial capacity utilization rate in China fell to 75.1% in Q2 2022 from 78.4% in the same period a year earlier.

� Brent crude prices declined by 6% as investors priced in Saudi Arabia�s oil output increase post the meeting with US president.

� Gold extended losses toward the USD 1,700 an ounce level on Friday, as the USD is trading at near 20-year highs on expectations the Fed will continue its aggressive rate hikes.

��