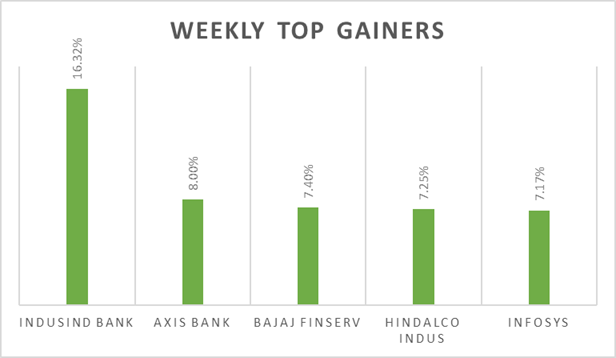

Sensex & Nifty will react to earnings reported by Infosys, Reliance Industries, ICICI Bank and Kotak Mahindra Bank over the weekend. Combinedly above 4 scrips have 30% weightage in Nifty 50. Reliance Industries reported flat QoQ growth despite higher GRM for the quarter, underperformance from O2C segment impacted earnings. ICICI Bank reported 20% NII growth and sequential decline in NPAs. IT sector has been under everyone�s radar due to higher valuations, declining margins, and higher attrition rate. Infosys reported 5% QoQ (constant currency) revenue growth, operating margins declined to 20% from 23% seen in Q1Fy22. However, Infosys management raised revenue forecast to 14%-16% from 13%-15% amidst weakening global economy.

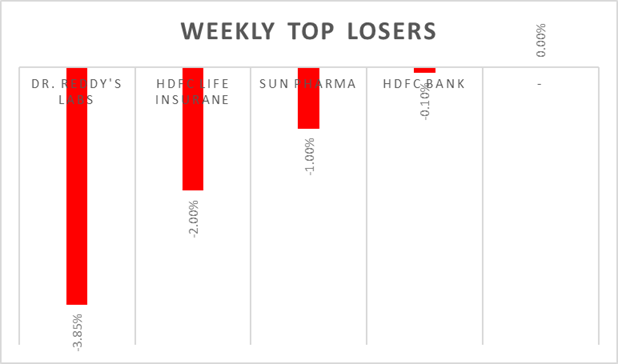

�Action packed week ahead for investors as Fed will come out with policy-meeting outcome, US will report GDP growth and corporate earnings. Domestic investors will watchout for Asian Paints, Dr. Reddy�s Lab, Sun Pharma, Maruti Suzuki, Bajaj Auto and Tech Mahindra Q1FY23 earnings.

Equity Market Summary:

� In domestic markets FIIs/FPIs sold Rs. 502 billion in May 2022 and bought Rs.10 billion in July 2022 (as of 24th July 2022).

� Wallstreet indices declined amid disappointing corporate earnings reports from Twitter and Snap. On the data front, the US business activity contracted in July 2022 for the first time in two years, pressured by a sharp slowdown in the service sector.

� S&P Global US Services PMI fell to 47 levels in July 2022 from 52.7 levels in June 2022, missing market expectations of 52.6 levels and signalling the sharpest fall in output since May 2020.

� ECB raised its interest rates by 50bps during its July 2022 policy-meeting, the first increase since 2011, ending eight years of negative rates, in an attempt to release the inflationary pressures.

� S&P Global Services PMI for the Euro Area fell to 50.6 levels in July 2022 from 53 levels in June 2022 and well below market forecasts of 52 levels.

� Jibun Bank Japan Composite PMI fell to 50.6 levels in July 2022 from a final 53 levels a month earlier, flash data showed.

� Core consumer price index in Japan, which excludes fresh food but includes fuel costs, increased 2.2% in June 2022 from a year earlier.

� Brent crude futures traded below USD 104 per barrel on Friday, amid weakening US gasoline demand.

� The number of Americans filing new claims for unemployment benefits jumped by 9,000 to 251,000.

� US crude oil inventories declined by 0.446 million barrels in the week ended 15th July, following an injection of 3.254 million barrels.

��