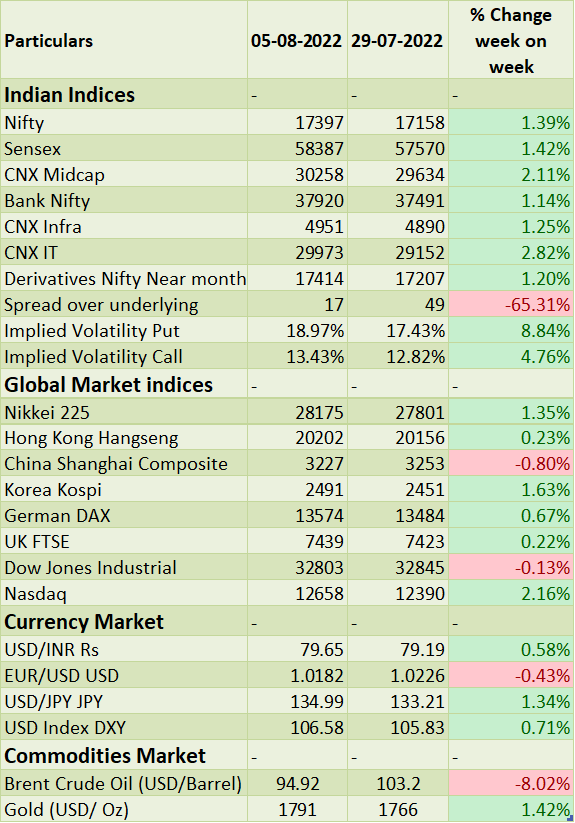

Sensex & Nifty would witness volatility amid stronger US jobs data which increases the chance of Fed hiking rate by 0.75% in September 2022 policy-meeting. US CPI data which is due in next week would be key deciding factor for the Fed about future rate hikes.

Aggressive rate hikes by Fed would lead to capital outflows to safe-haven assets like USD. On earnings front, there are no signs of declining demand, but corporates have seen margin erosion due to higher raw material prices. Geo-political tensions between Taiwan & China would be key factor which would decide market trend.

In the previous week RBI hiked repo rate by 50bps compared to market expectations of 35bps. Given global inflation expectations are high and policy makers are likely to stay aggressive on hiking rates, Sensex, Nifty & INR would see selling pressure. Hence, market participants would see uptick VIX in the coming week.

Global investors will watch out US inflation data, Fed speakers� speech and China�s trade data. Domestic investors will watchout for IIP and inflation data points.

Equity Market Summary:

� In domestic markets FIIs/FPIs bought Rs.49 billion in July 2022 and Rs. 141 billion in August 2022 (as of 07th August 2022).

� Wallstreet indices closed on negative note after witnessing volatile session due to strong non-farm payroll data which would trigger 75bps rate hike by Fed in coming policy-meeting.

� US economy added 528,000 jobs in July 2022, much better than market forecasts of 250,000.

� US unemployment rate decreased to 3.5% in July 2022.

� After strong jobs data 10 yr UST yields moved sharply to 2.88% and DXY touched 107.

� Brent crude oil prices declined by 8% during the week as the global economic slowdown concerns rose.

� BoE raised interest rates by 50bps to 1.75% and guided that inflation would touch 13.3% by October 2022.

� Industrial production in Germany unexpectedly rose by 0.4% MoM in June 2022.

��