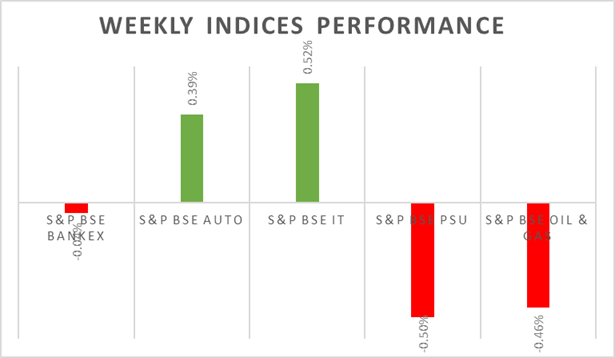

Sensex & Nifty reported weekly gains of 0.30% which is 5th straight week of weekly gains. Amid profit booking seen in markets, Nifty declined by 1% on Friday. Going forward, markets are likely to discount further course of rate hikes from Fed and other central banks. Domestic F&O expiry which is due in the coming week would add volatility. FIIs/FPIs bought Rs.49 billion in July 2022 and Rs. 444 billion in August 2022 (as of 21st August 2022). On global front, market participants will keenly watch for Fed Chair Jerome Powell's speech at the Jackson Hole symposium.

Equity Market Summary:

o Wallstreet indices closed sharply lower on Friday as Fed policymakers said they are leaning towards 3rd consecutive 75bps rate hike in September policy-meeting.

o 10-year UST closed at 2.97% amid higher interest rates expectations.

o European markets declined sharply on Friday amid expectations of higher inflation which would push central banks to hike rates sharply during September policy-meeting.

o Euro Area current account surplus narrowed sharply to EUR 3.2 billion in June 2022 from EUR 27.6 billion compared to previous year.

o Annual inflation rate in Japan rose to 2.6% in July 2022 from 2.4% in June. This was the 11th straight month of increase in consumer prices and the fastest pace since April 2014.