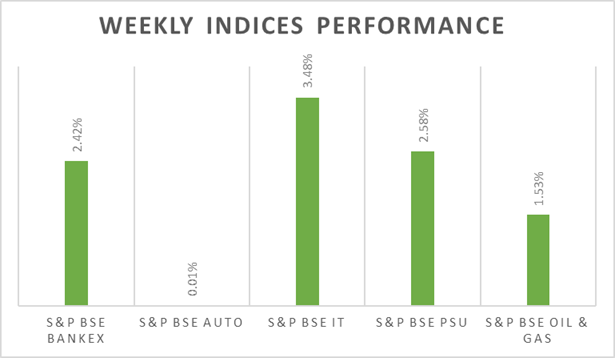

�Nifty might break 18,000 level if inflation data comes in lower than expected, on contrary note higher inflation would lead to knee jerk reaction in global equities. Domestic inflation 1 year forward is at 17 months low and in US inflation is expected to come in lower than July�s figure. During the week Sensex & Nifty gained by 1.68% mainly driven by IT stocks.

In the coming week, US & India inflation and China industrial production data points will be keenly watched.

Equity Market Summary:

o Wallstreet indices closed higher on Friday as inflation expectations for August are lower than July�s CPI print. Market movement came a day after Fed chair Jerome Powell, in a speech reiterated that the central bank would do what it takes to tame inflation, further curbing any speculation of an imminent policy pivot.

o Trade deficit in the US narrowed by USD 10.2 billion in July 2022, broadly in line with market forecasts as exports rose to record highs.

o European markets closed positive on Friday despite a week of unexpected series of events. ECB hiked rated by 75bps during policy-meeting and Russia has cut gas supplies to Europe which further increasing inflation expectations.

o ECB raised interest rates by an unprecedented 75bps in its September policy-meeting, also stated that interest rates should rise further over the next several meetings.

o Japanese economy grew 3.5% on an annualized basis in Q2 2022, compared with market forecasts of a 2.9%.

o Food prices in China increased by 6.1% YoY in August 2022, slowing from a 6.3% rise a month earlier which was the fastest pace in 22 months.