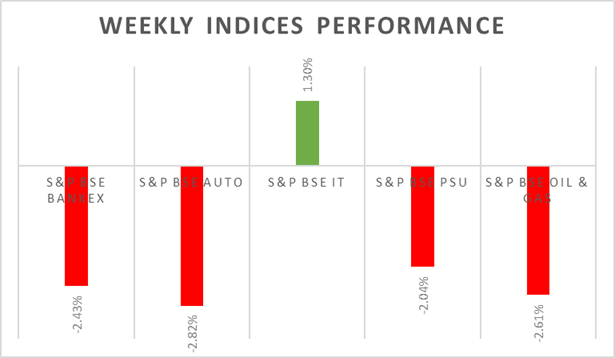

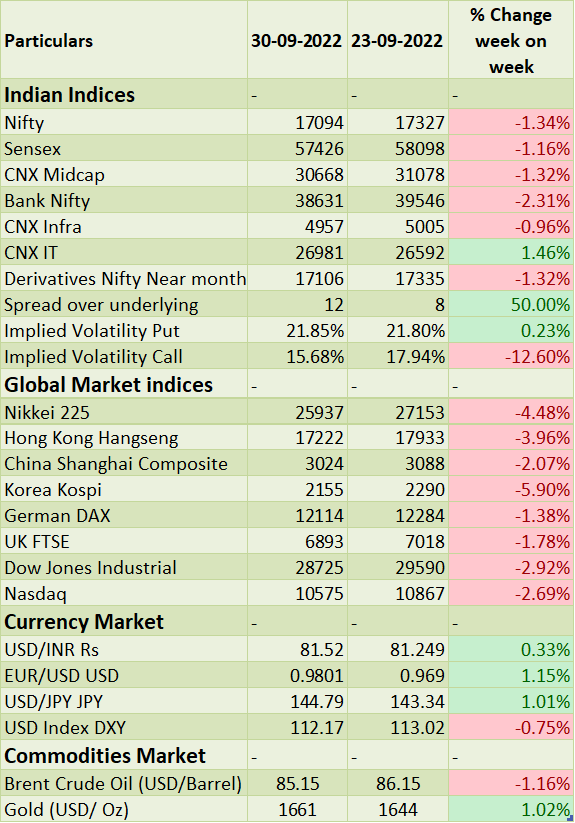

�Sensex & Nifty declined only 1.3% compared to global indices which declined by 3% to 5% during the previous week. Global equities were under fire sales especially UK stocks after England gilts (government bonds) risen sharply above 4% which caused pension funds to liquidate their risky asset positions to pay margin calls. Rising global yields crisis would have ripple on effect on global economies as the financial institutions will have to book losses in alpha generating strategies (stocks, currencies and etc..) to maintain adequate liquidity. From the latest news, Credit Suisse CDS (credit default swaps) have reached higher levels which were seen during 2007-08 financial crisis showing signs of distresses in their financial position.

On the domestic macro-economic front, India current account deficit widened to USD 23.9 billion in the Q2 2022, the highest since the Q4 2012. The Reserve Bank of India raised its key repo rate by 50 bps to 5.9% during its September policy-meeting, the fourth-rate hike in a row as the Rupee touches record lows. India's infrastructure output growth slowed to 3.3% (YoY) in August 2022 from 4.5% in the previous month.

In the coming week, US NFP and PMIs data points will be keenly watched. Domestic investors will watch out for upcoming Q2Fy23 earnings season.

Equity Market Summary:

o Wallstreet indices declined after opening gap up on Friday amid weak economic data points. US core PCE reported at higher than expected which shows incoming inflation data is likely to be higher than expectations.

o University of Michigan consumer sentiment for the US was revised lower to 58.6 levels in September 2022 from a preliminary level of 59.5.

o European equities closed positive as investors rushed to pick stocks from few selected sectors after witnessed sharp sell-off during the week.

o Preliminary estimates of annual inflation rate in the Eurozone jumped to 10% in September 2022 from 9.1% in August 2022, reaching double-digits for the first time ever.

o Industrial production in Japan rose by 2.7% (M-o-M) in August 2022.

o Non-Manufacturing PMI for China declined to a 4-month low of 50.6 in September 2022 from 52.6 a month earlier