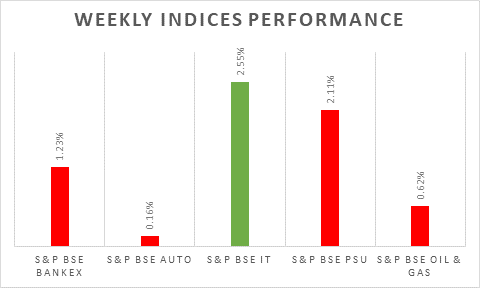

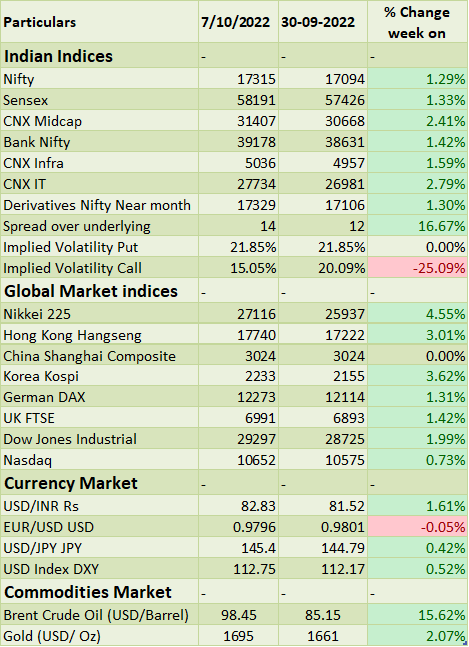

Sensex and NIFTY rose by 1.31% while major global equity indices increased by 2% to 4.55% during last week. US non-farm unemployment rose by 263,000 in September 2022 while unemployment rate fell to multiyear low to 3.5%. US average hourly earnings declined to 5% in Sep 22 on a yearly basis. According to ECB monetary policy meeting minutes, members have backed aggressive rate hikes for curbing inflations.

On domestic front, manufacturing PMI stood at 55.1 in Sep 22 as compared to 56.2 in previous month. Macro-economic data like inflation and industrial production will be keenly watched by investors this week.

Equity Market Summary:

o Wallstreet indices gained as investor’s sentient were positive by the report of The Institute for Supply Management that price pressures facing manufacturers fell to their lowest level since soon after the start of the pandemic, while nonmanufacturing prices rose at the slowest pace since January 2021.

o US Composite PMI final rose to 49.5 in Sep 22 from 44.6 in previous month.

o European equities closed positive following global indices as investors expect central bank might scale back rate hikes in coming days.

o Eurozone Producer Price Inflation (PPI) soared to 43.3% in Aug 22 from 38% in Jul 22.

o Eurozone Composite PMI stood at 48.1 in Sep 22 as compared to 48.9 in previous month.

o China Composite PMI fell to 48.5 in Sep 22 from 53 in previous month.