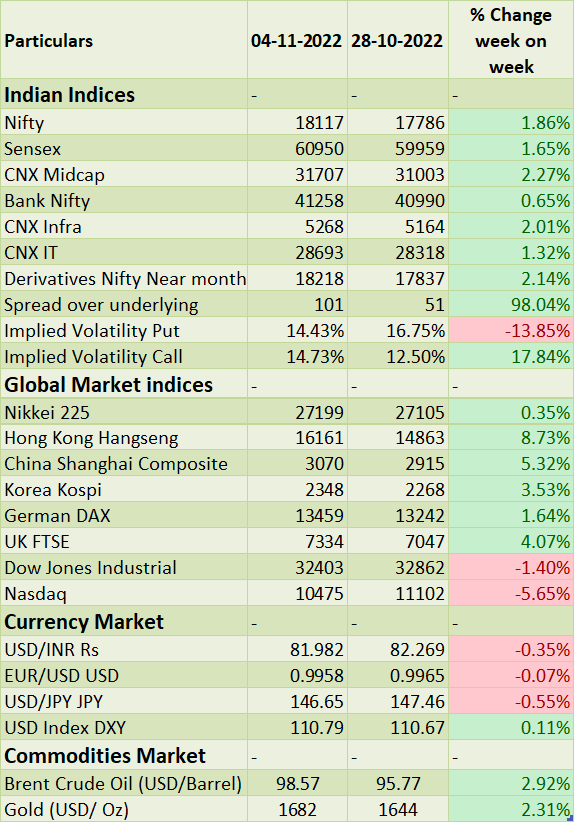

�Sensex & Nifty reported another week of above 1.5% weekly gains, metal stocks have outperformed broader index as China has eased local Covid-19 policies which boosted sector sentiment. On the global cues front, mixed US jobs data will set higher expectations for future rate hikes by Fed. However upcoming US inflation data would decide whether next rate hike pace by Fed.

Domestic IPO market space will continue to be busy as four companies hit the market to raise funds from investors of Rs.50 billion. In the coming week, investors will watchout for US inflation data and domestic corporate earnings.

Equity Market Summary:

o Wallstreet indices closed positive after a volatile session on the back of mixed jobs data. Also, Fed committee member hinted that the pace of future increases could be smaller but did not rule out another 75-bps hike in December 2022.

o US economy added a stronger-than-expected 261,000 jobs in October 2022, above market forecasts of 200,000.

o Federal Reserve raised the target range for the federal funds rate by 75bps to 3.75%-4% during its November 2022 policy-meeting. It marks a 6th consecutive rate hike and the 4th straight 75bps increase, pushing borrowing costs to a new high since 2008.

o US ISM Services PMI fell to 54.4 levels in October 2022 from 56.7 levels in September 2022, and below market forecasts of 55.5 levels, pointing to the slowest growth in the services sector since a contraction in May 2020.

o European markets rebounded by 2% as investors digested the latest central bank meetings and solid corporate earnings.

o S&P Global Eurozone Services PMI was revised higher to 48.6 levels in October 2022, but still pointed to a third consecutive month of falling services activity and the biggest since February last year, due to weaker demand.

o Producer price inflation in the Euro Area eased to 41.9% (Y-o-Y) in September 2022, down from an all-time high of 43.4% in August 2022 and slightly below market expectations of 42%.

o Bank of England voted by a majority of 7-2 to raise interest rates by 75 bps to 3% during its November policy-meeting, the largest rate hike since 1989, increasing the cost of borrowing to the highest level since late-2008.

��������������