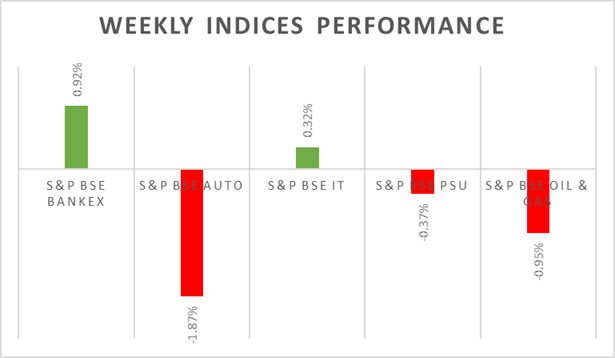

�Sensex & Nifty witnessed volatility on Friday and Nifty continued to see selling pressure at 18400 levels. During the week, PSU index outperformed the Nifty and Auto index declined the most. FIIs/FPIs are net buyers of stocks worth Rs. 303 billion in the month of November 2022 (as of 20th November 2022). Global market sentiment was dampened on Friday on the back hawkish talks from Fed officials, will resulted in sell-off in sell-off in tech stocks. Markets will continue to calibrate pace & direction of US Fed rate hikes in coming weeks.

Equity Market Summary:

o Wallstreet indices closed slightly higher on Friday as most of the optimism about upbeat earnings was offset by persistent concerns about a Fed-induced downturn. Hawkish speeches from several Federal Reserve policymakers dashed hopes of a pause in the central bank's tightening cycle.

o European indices rallied by 1% on Friday despite ECB President Christine Lagarde said the central bank would keep hiking interest rates and may even need to restrict growth to rein on inflation.

o Euro Area recorded a trade deficit of EUR 34.4 billion in September 2022, the 11th consecutive gap and the third highest on record, as soaring energy prices inflated the turnover of imports.

o Annual inflation rate in the UK jumped to 11.1% in October 2022 from 10.1% in September 2022, much higher than market forecasts of 10.7%.

o The core consumer price index in Japan, which excludes fresh food but includes fuel costs, jumped 3.6% in October 2022 from a year ago, accelerating at the fastest pace since February 1982.

o Japan's trade deficit surged sharply to JPY 2,162.3 billion in October 2022 from a JPY of 90.7 billion in the same month a year earlier and compared with market consensus of a gap of JPY 1,610 billion.

o Industrial production in Japan declined by 1.7% MoM in September 2022, compared with a flash reading of a 1.6% drop.

o Japanese economy shrank 0.3% on quarter in the three months to September 2022, missing market consensus of a 0.3% growth.