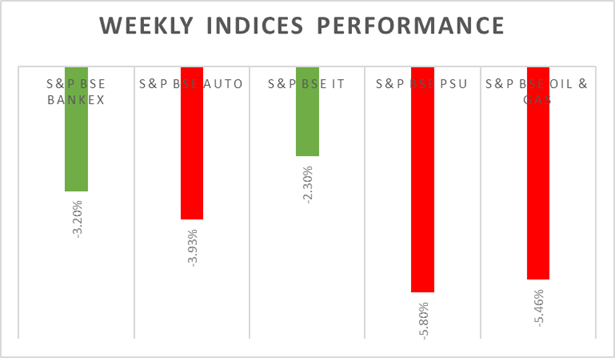

�Sensex & Nifty declined by 6% from the fresh record-highs amid fears of Covid resurgence and weak global cues. As the holiday week starts across the globe, Sensex & Nifty are likely to be range bounded with negative skewness. �FIIs/FPIs are net buyers of stocks worth Rs. 115 billion in the month of December 2022 (as of 25th December 2022).

Volatility across the globe rose as a new strain of Covid variant is spreading. Nifty VIX moved to 16% and likely to go up further on the back of monthly F&O expiry week. �

Equity Market Summary:

o Wallstreet indices erased early losses and closed on positive note on Friday. The core PCE price index, the Fed�s preferred inflation gauge, slowed more than the FOMC had forecasted in its projections last week which boosted market sentiment.

o The personal consumption expenditure price index in the US increased by 5.5% (Y-o-Y) in November 2022, the least since October 2021 and below 6.1% in October.

o The core consumer price index in Japan, which excludes fresh food but includes fuel costs, jumped 3.7% in November 2022 from a year ago, accelerating at the fastest pace since December 1981 as broadening inflationary pressures continued to spread through the economy.

o The number of Americans filing new claims for unemployment benefits rose by 2,000 to 216,000 in the week ending 17th December 2022, below market expectations of 220,000 and extending signals of a stubbornly tight labor market.

o Stocks of crude oil in the US fell by 5.894 million in the week ended 16th December 2022 way more than market forecasts of a 1.657 million drop, the latest US Energy Information Administration report showed.