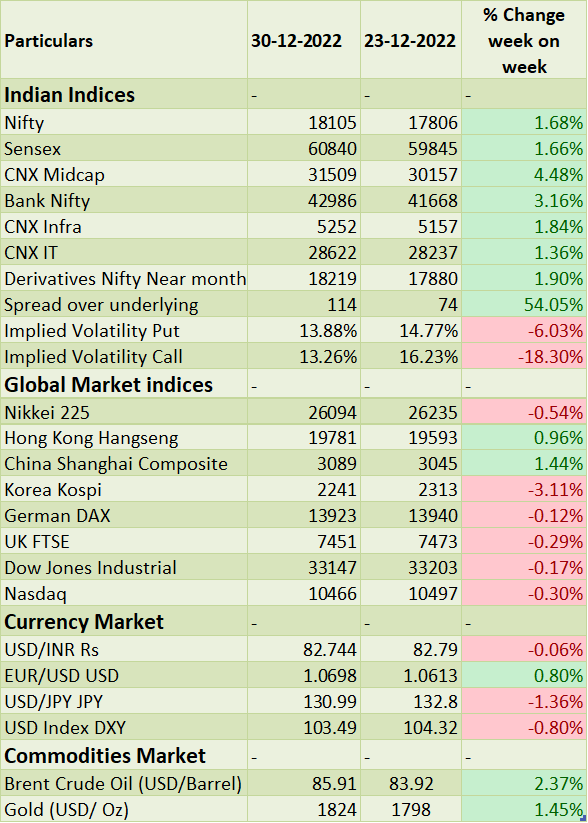

�Sensex & Nifty gained by 1.6% during last week and for the year 2022 both indices recorded close to 5% gains which is 7th consecutive yearly gains. In 2023 market participants focus will be on RBI rate hikes, corporates growth expectations & CAPEX plans and foreign inflows. FIIs/FPIs outflows for the CY 2022 stood at 1214 billion. On the macro-economic data front, India�s current deficit at record high level of 4.4% of GDP. Infrastructure output in India which accounts for nearly 40% of industrial output, increased 5.4% (Y-o-Y) in November 2022.

Equity Market Summary:

o Wallstreet indices closed on negative note on Friday and recorded worst annual performance since 2008. In 2002, Dow jones declined by 8.8%, S&P 500 fell by 19.5% and Nasdaq slumped by 33.3%.

o European equities declined on Friday tracking US markets. For the year 2022 DAX declined by 12%.

o Profits earned by China�s industrial firms declined on an annual basis by 3.6% to 7.7 trillion yuan in the January-November period.

o China NBS Manufacturing PMI was down to 47 levels in December 2022 from 48 levels in the previous month, pointing to the 3rd straight month of drop.

o Consumer inflation in South Korea was at 5% (Y-o-Y) in December 2022.