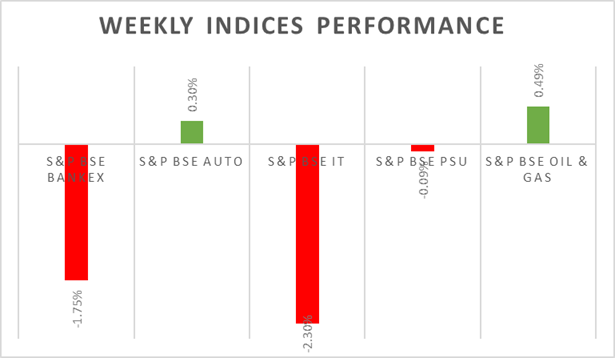

�Sensex & Nifty closed first week of 2023 on a negative note losing as much as 1.5% during the week. Q3 earnings and budget expectations will drive markets in near future. On earnings front, revenue growth estimates for Q3 are expected to be lower to high base and margin expansion would be recorded on the back of cooling commodity prices. On the global front, Eurozone inflation is still above 9% but lower than record highs and US job market is showing signs of cooling which would reduce the pace of rate hikes by Fed.

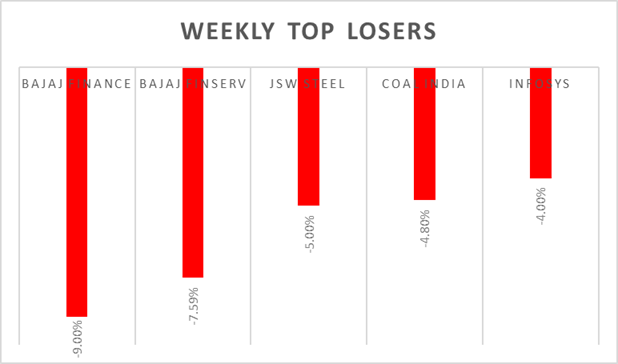

In the coming week, TCS, Infosys, Wipro and HDFC bank are expected to release results and US inflation data will be keenly watched by investors.

Equity Market Summary:

o Wallstreet indices closed on a strong positive note on Friday after US wage growth unexpectedly slowed down in December 2022 which drove investors to ease expectations of aggressive monetary tightening by the Fed.

o European equity markets rose on Friday, investors reacted to economic data from the US and the Eurozone.

o US trade deficit narrowed to USD 61.5 billion in November 2022, the lowest since September 2020, and below forecasts of a USD 73 billion gap.

o The ISM Services PMI for the US fell to 49.6 levels in December 2022, well below market forecasts of 55 levels, and compared to 56.5 levels in November 2022.

o Fed policymakers continued to anticipate that ongoing increases in the federal funds rate would be appropriate - from the December policy meeting showed.

o Annual inflation rate in the Euro Area fell to 9.2% in December 2022, the lowest in 4 months, and below forecasts of 9.7%, preliminary estimates showed.

o China's foreign exchange reserves rose to USD 3.128 trillion in December 2022 from USD 3.117 trillion in the previous month.