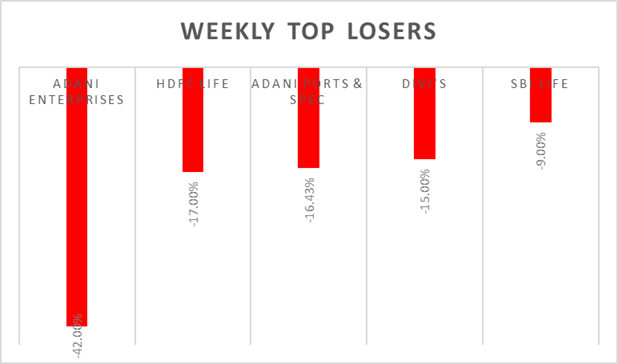

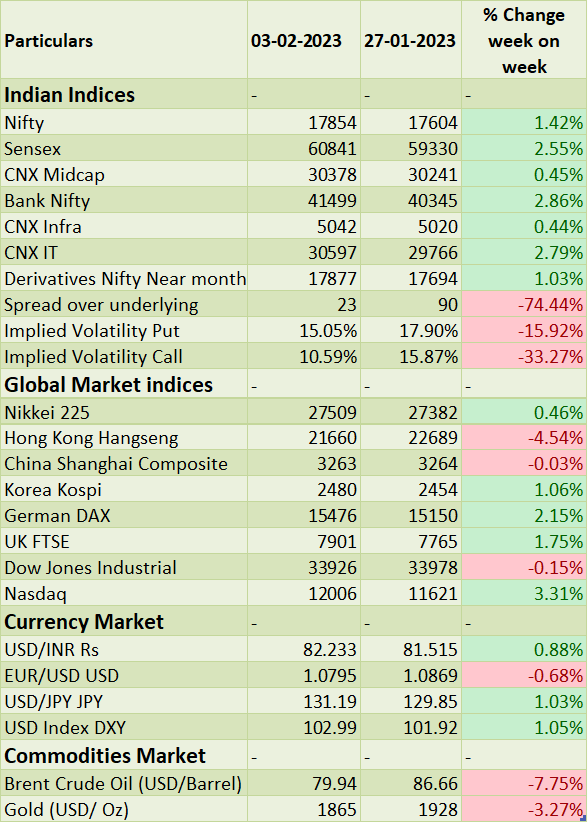

�Indian budget session outcome was positive, total borrowing for Fy24 is set at Rs. 15 trillion which lower than market expectations and fiscal deficit is estimated to be at 5.9% of GDP. Overall reaction to budget was positive, equity markets are up more than 1% during the week and bond yields fell to 7.26%. However, negative news around Adani group of companies is a major set back for Indian equity markets and we could see more volatility in Adani stocks in coming week.

On central banks policy front, Fed, ECB, BoE hiked rates sharply and guided for similar pace of rate hikes in next policy-meeting. Policy makers concerns about inflation and interest rate hikes are still prevalent and could lead to market volatility in the coming weeks.

Equity Market Summary:

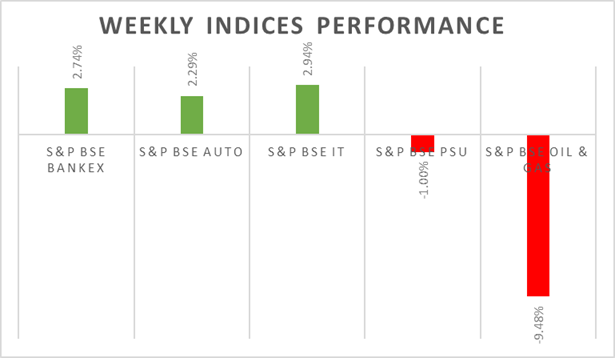

o Wallstreet indices closed lower on Friday amid strong jobs data would push Fed to stick with tightening the interest rate hike cycle. On weekly basis, Dow Jones down by 0.15%, Nasdaq up by 3.3% and S&P 500 gained by 2.1%.

o US economy added 517,000 jobs in Jan 2023, more than market expectation and unemployment rate fell to 3.1%.

o US PMI services level jumped to 55.2 in Jan 2023 from 49.2 levels seen in December and beating market forecast.

o Fed hiked interest rate by 0.25% and stated that they�re unlikely to pivot from 2023 interest rate hike cycle as guided earlier.

o ECB raised interest rates by 50 bps to 3% taking rates to higher levels seen in 2008. Policy members guided for another round of 50bps hike in March policy-meeting.

o BoE rose interest rate by 50bps to 4% and market expectations for the interest rate to be at 4.5% by end of 2023.