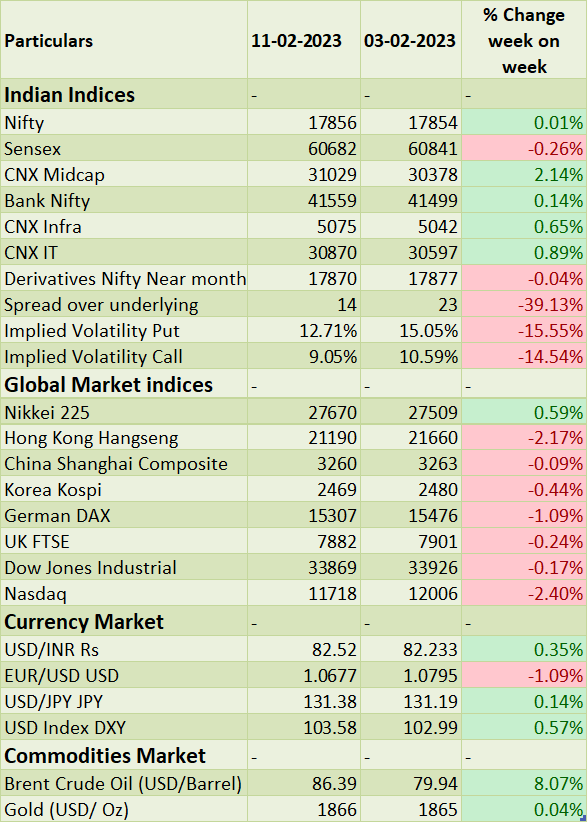

Sensex & Nifty lacking directional momentum during the week, hence close on flat note. Going forward, global cues and inflation data will set momentum for the indices. Reserve Bank of India raised its key repo rate by the expected 25 bps to 6.5% during its February 2023 meeting, the sixth rate hike in a row, amid easing inflation. Industrial production in India increased 4.3% YoY in December 2022, easing from an upwardly revised 7.3% rise in November 2022, and slightly below market forecasts of a 4.5% gain.

Equity Market Summary:

o Wallstreet indices closed on mixed note on Friday, Dow Jones and S&P 500 were up by 0.2% and Nasdaq index closed negative. Investors digested the most recent economic data and comments from Federal Reserve speakers after hawkish remarks from Federal Reserve officials that brought down the hope of a pause in rate hikes.

o European indices fell sharply on Friday, extending a global rout as investors fretted about the prospect of further policy tightening from the European Central Bank and Federal Reserve amid their commitment to bring down inflation.

o China's annual inflation rate rose to 2.1% in January 2023 from 1.8% in December, compared with market forecasts of 2.2%.

o Crude futures were up almost 3% to after Russia announced its plans to cut output by 500,000 barrels a day in March, 5% of total production.