Equity Market Summary:

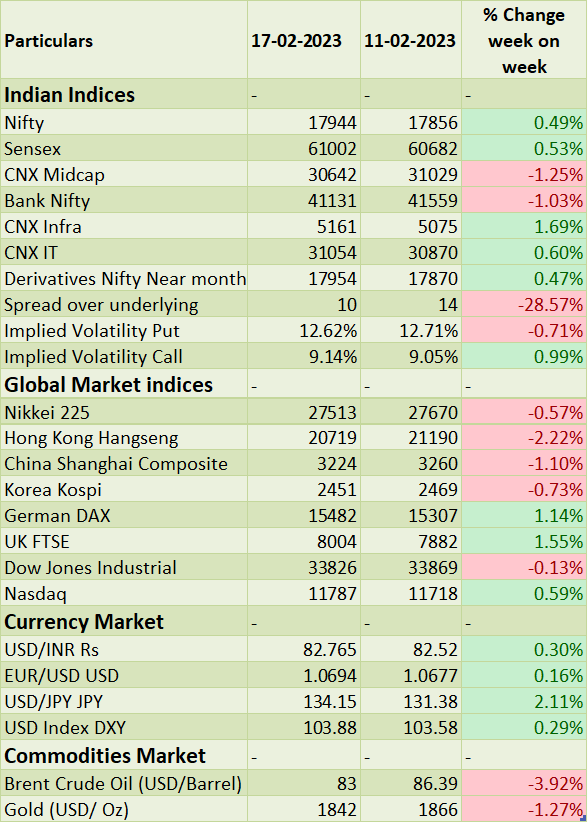

o Wallstreet indices closed on mix note on Friday. On weekly basis, declined as investors expect Fed to hike rates further as macro data suggest higher inflation likely to be sticky than fall sharply.

o Industrial production in the US was unchanged in January 2023 after falling by a revised 1% in December, missing market expectations of a 0.5% increase.

o Industrial production in the Euro Area dropped 1.1% from a month earlier in December 2022, following an upwardly revised 1.45 growth in November and compared with market expectations of a 0.8% decline.

o The current account surplus in the Euro Area widened to EUR 28.9 billion in December 2022 from EUR 21.9 billion in the same month last year.

o Japan's trade deficit widened to a record high of JPY 3,496.6 billion in January 2023 from JPY 2,199.4 billion in the same month a year earlier, compared with market consensus of a gap of JPY 3,871.5 billion.

o Crude oil �prices declined about 4% last week, as rising US crude supplies and the prospect of further Federal Reserve policy tightening outweighed optimism over China�s demand recovery.