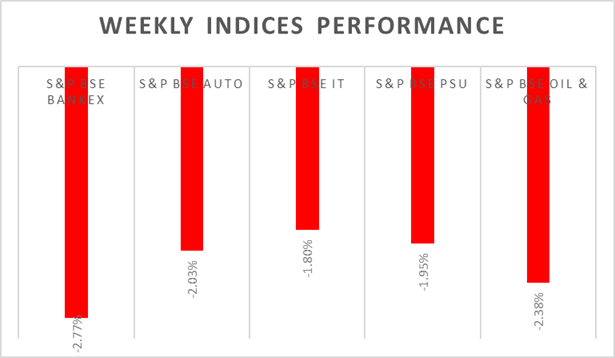

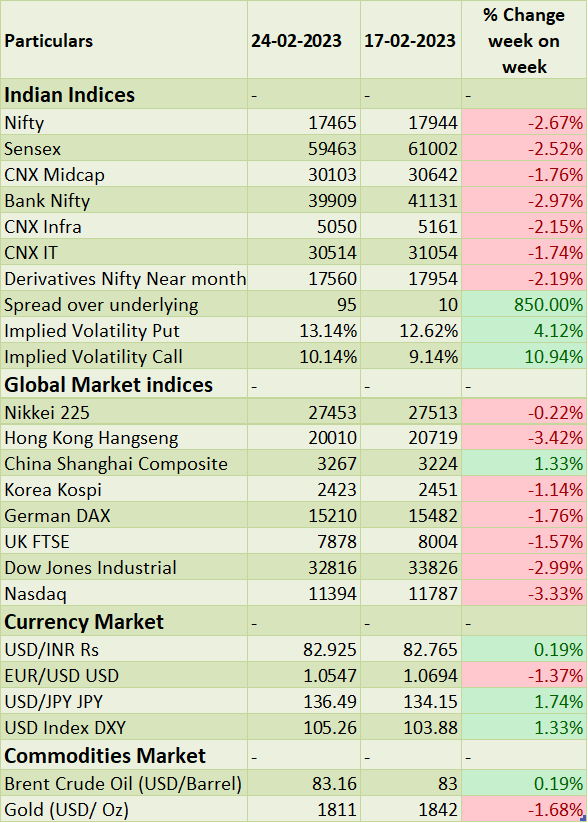

Sensex and Nifty declined by 2.5% during the last week, steepest weekly fall since August 2022 as the FII outflow and negative global cue impacted market sentiment. On the global front, due to higher inflation data expectations markets are expecting Fed to continue the pace of rate hikes which resulted to decline in prices of UST.

FIIs/FPIs outflows stood at Rs. 311 billion YTD, more outflow pressure from FIIs/FPIs would yield in further sell-off in Sensex & Nifty. In the coming week, investors will watchout for global PMI levels, domestic Q3 GDP data and Eurozone inflation data.

Equity Market Summary:

o Wallstreet indices closed on negative note as the PCE estimates for the month reported at 4.7% and market estimates stood at 4.3%, causing worries of higher inflation. PCE is personal consumption expenditure, Fed�s preferred gauge of inflation.

o European markets declined on Friday, tracking US markets. Investors are worried about Fed�s rate hike pace to increase on the back of high PCE data leading to higher inflation and also, Fed minutes showed few policymakers are inclined towards 50bps rate hike which would be more likely case if inflation remains sticky.

o Most of FOMC participants agreed that it was appropriate to raise the target range for the federal funds rate by 25bps at the first monetary policy meeting of 2023, although a few officials favoured raising it by 50bps, minutes from the last meeting showed.

o Annual inflation rate in Japan rose to 4.3% in January 2023 from 4% in the prior month. This was the highest reading since December 1981, amid a rise in prices of imported raw commodities and yen weakness.