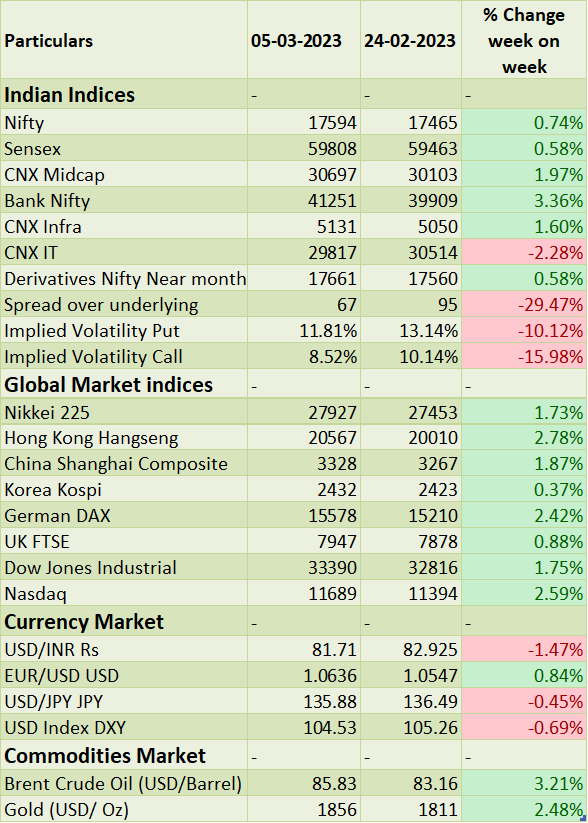

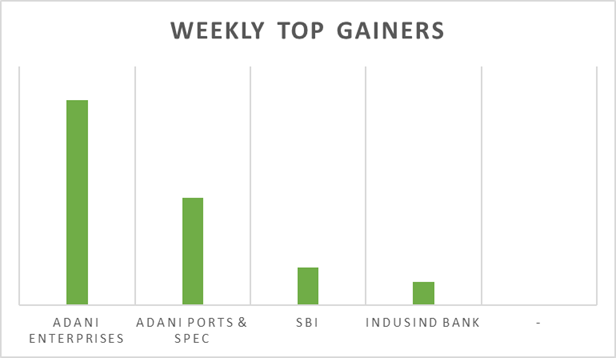

�Sensex & Nifty ere up as much as 1.5% on Friday, erasing recent losses to close the week 0.6% higher, supported by a broad-based rally as bond yields softened and the rupee rebounded from recent lows. Sentiment was further boosted after US firm GQG Partners placed a USD 1.87 billion investment in Adani conglomerate assets, raising hopes that the group can still raise capital.

�FIIs/FPIs domestic outflows stood at Rs. 252 billion YTD. �In the coming week, US NFP jobs data and China GDP growth & inflation will be in focus.

Equity Market Summary:

o Wallstreet indices closed on a strong positive note as investors understood from Fed reserve official speeches that Fed is likely to for a 25bps rate hike and unlikely for anything higher, this also resulted in fall in 10 yr UST yield.

o European markets rose on Friday tracking positive global cues and domestic OEM Volkswagen raised forecast for Cy23 which boosted sentiment too.

o S&P Global Eurozone Composite PMI was revised lower to 52 levels in February 2023, slightly down from a preliminary estimate of 52.3 levels and compared with January's 50.3 levels.

o The consumer price inflation in the Euro Area inched lower to 8.5% in February 2023, the lowest since last May 2022, but above market expectations of 8.2%.

o The au Jibun Bank Japan Services PMI was revised higher to 54 levels in February 2023 from a preliminary estimate of 53.6 levels, signalling a solid expansion in activity.

o The Caixin China General Services PMI climbed to 55 levels in February 2023, up from 52.9 levels in the previous month, signalling the fastest pace of expansion in activity since last August 2022.