�Sensex & Nifty declined by 2% in the last week amid investors concerns over the banking crisis and Fed�s monetary policy-meeting. Going forward, global cues will set trend for domestic indices and on positive side, oil prices declined sharply, and trade deficit declined in Feb 23. On Sunday, Swiss government has forced takeover of Credit Suisse by UBS for a deal worth of USD 2 billion, which quarter of Fridays market cap of Credit Suisse i.e USD 8 billion.

�FIIs/FPIs domestic outflows stood at Rs. 226 billion YTD. �In the coming week, all the attention will turn to the Federal Reserve's latest monetary decision after recent turmoil in the banking sector.

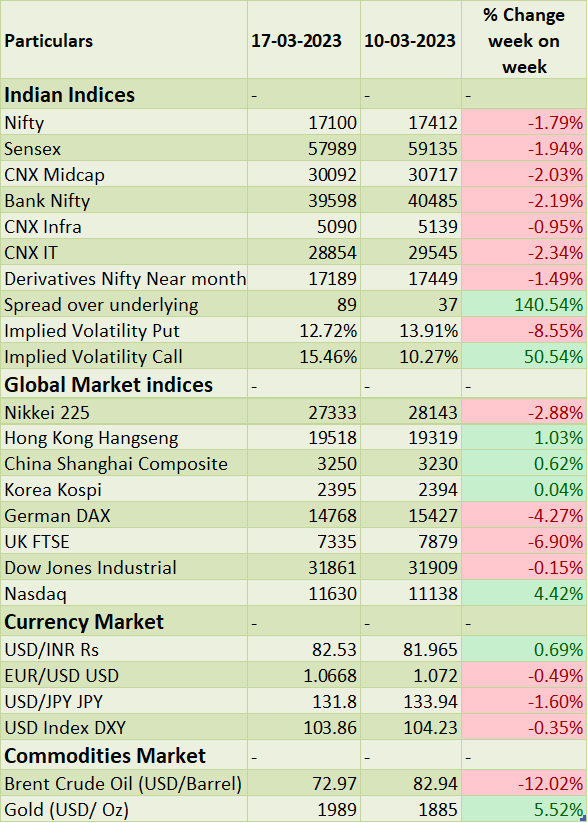

Equity Market Summary:

o Wallstreet indices closed on negative note, amid concerns over the banking sector turmoil. During the week, Dow Jones declined by 0.15%, Nasdaq surged by 4.4% and S&P 500 up by 2%.

o European markets closed in red territory tracking weak global cues about potential banking crisis.

o Annual inflation rate in the US slowed to 6% in February of 2023, the lowest since September 2021, in line with market forecasts, and compared to 6.4% in January.

o Industrial production in the US was unchanged in February 2023, missing market expectations of a 0.2% increase after rising by 0.3% in January 2023.

o ECB raised interest rates by 50 bps as expected on Thursday, further pushing borrowing costs to the highest level since late 2008, in order to help temper the region�s stubbornly high inflation.

o Industrial production in Japan dropped by 5.3% month-over-month in January 2023, compared with a flash figure of a 4.6% fall.

o China's industrial production advanced 2.4% YoY in January-February 2023 combined, faster than a 1.3% gain in December 2022 but less than market forecasts of 2.6%.