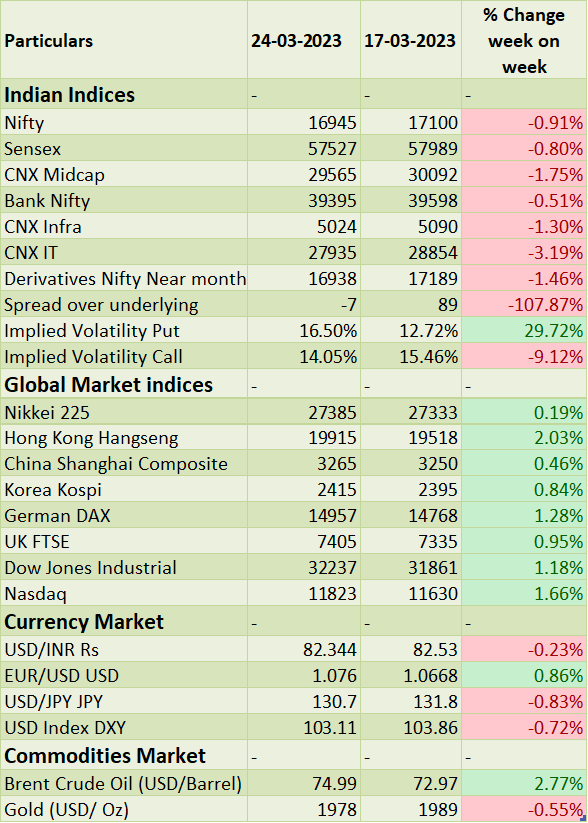

�Sensex & Nifty declined by 1% amid global banking crisis, in the latest headlines Deutsche bank shares were under heavy pressure as the CDS spreads climb to highest levels. Global central banks assured to keep enough interbank liquidity so that banks won�t have bank runs. On domestic front, Government has included removal of LTCG on debt mutual funds and hiked STT for F&O contracts in Finance bill FY24.

�FIIs/FPIs domestic outflows stood at Rs. 269 billion YTD. �In the coming week, all the attention will turn to the Federal Reserve's inflation gauge PCE and Europe inflation levels.

Equity Market Summary:

o Wallstreet indices bounced back from negative opening and closed on positive note on Friday. Share price of Deutsche bank fell as much as 14% on Friday before recovering as the concerns over bank�s liquidity conditions escalated.

o European equity market fell on Friday, extending the previous session's decline, as concerns over the health of the banking sector mounted. CDS spreads of Deutsche bank touched new highs since the launch in 2019.

o Fed raised the fed funds rate by 25bps to 4.75%-5% in March 2023, matching the February increase, and pushing borrowing costs to new highs since 2007, as inflation remains elevated.

o Bank of England raised its key bank rate by 25bps to 4.25% during the March 2023 policy-meeting, amid inflation rate in the UK unexpectedly edged higher to 10.4% last month from 10.1%.

o The core consumer price index in Japan, which excludes fresh food but includes fuel costs, rose 3.1% in February 2023 from a year ago, decelerating sharply from an over four-decade high of 4.2% in January.

o The yield on the US 10-year Treasury note fell by 11bps to 3.29% on Friday, the lowest since September of 2022, amid a flight to safety as the banking sector turmoil continued.