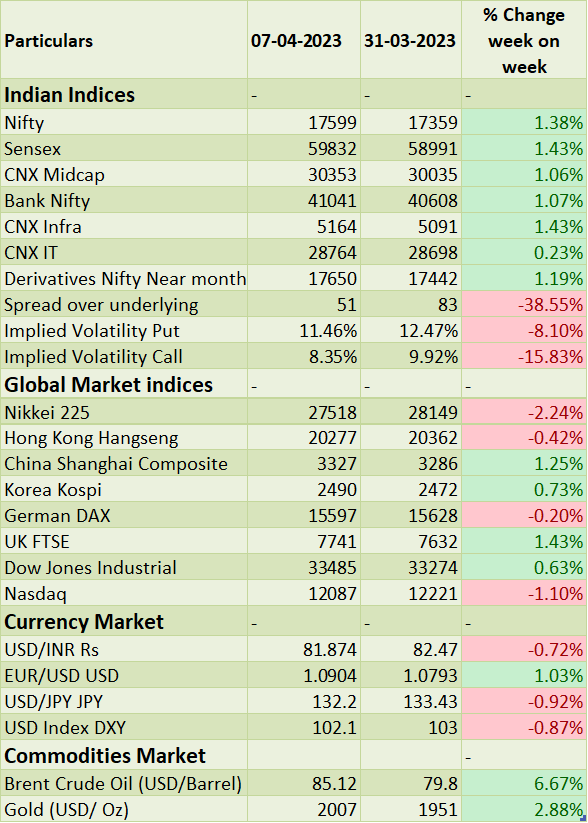

�Sensex & Nifty gained by 1.4% during the last week as short covering is seen on indices. Surprise move of not changing the interest rates by RBI during April policy-meeting boosted the market sentiment. However, this looks like a temporary pause in rate hikes and if inflation soars back, we might witness few more rate hikes before actual pivot in interest rates. As a result, 10-year government bond yields declined by 10bps to 7.2%.

�FIIs/FPIs domestic outflows stood at Rs. 224 billion YTD. �In the coming week, all the attention will turn to the inflation data from US & China. FOMC meeting minutes would help investors to understand forward interest rate path in US.

Equity Market Summary:

o The yield on the US 10-year Treasury note jumped almost 10bps to 3.37% on Friday, after the NFP report showed the US economy added 236,000 jobs in March 2023.

o The unemployment rate in the United States edged down to 3.5%in March 2023.

o US ISM Services PMI fell to 51.2 levels in March 2023 from 55.1 levels in February and well below forecasts of 54.5 levels.

o China General Services PMI increased to 57.8 levels in March 2023 from 55 levels in February, pointing to the largest expansion in activity since last November 2020, boosted by a sharp rise in new orders and employment after the easing of COVID-19 measures.