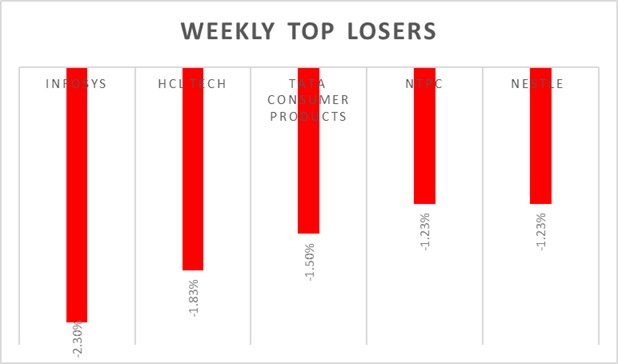

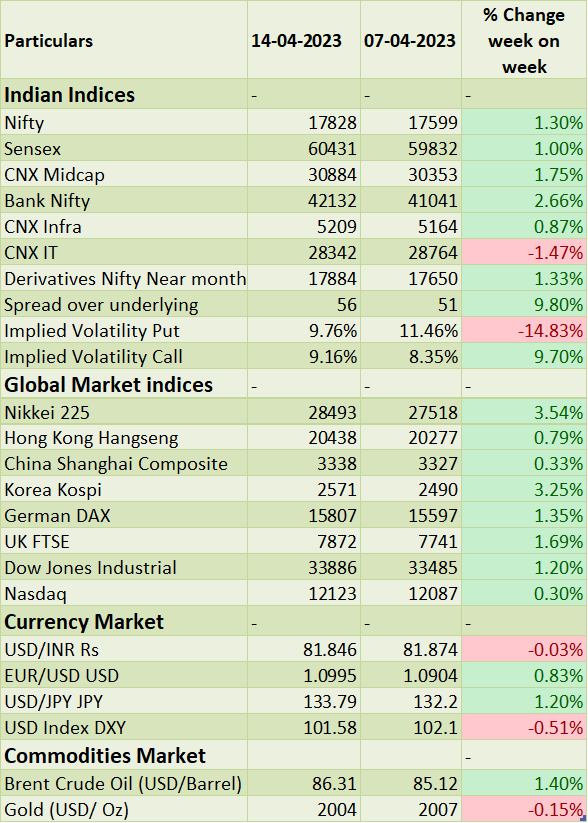

�Sensex & Nifty pared early losses and closed on flat note on Thursday, which is consecutive 9th day of positive closing. On macro-economic data, domestic CPI cooled down to 5.6% in March 2023 from 6.44% reported in February 2023, which boosted market sentiment. On corporate earnings front, TCS, Infosys and HDFC reported weak set of numbers, guidance of Infosys for Fy24 is at 4%-7%. Weak earnings from index heavy stock would drag Sensex & Nifty on Monday.

�FIIs/FPIs domestic outflows stood at Rs. 174 billion YTD. �In the coming week, investors will watchout for domestic earnings and China GDP growth data.

Equity Market Summary:

o Wallstreet indices declined on Friday as new macro-data i.e US consumer sentiment came in strong which would be a catalyst for Fed to hike rates in May policy-meeting.

o Industrial production in the US rose 0.4% MoM in March 2023, beating market expectations of a 0.2% increase and after an upwardly revised 0.2% gain in February 2023.

o FOMC members observed that inflation remained much too high and that the labor market remained tight and as a result, they anticipated that some additional policy firming may be appropriate to attain a sufficiently restrictive policy stance to return inflation to 2%, minutes from the March 21st-22nd policy-meeting showed.

o The annual inflation rate in the US slowed for a ninth consecutive period to 5% in March 2023, the lowest since May 2021 from 6% in February 2023.

o Industrial production in the Eurozone rose by 1.5% from a month earlier in February 2023, a second consecutive month of increase and above market expectations of a 1% growth.