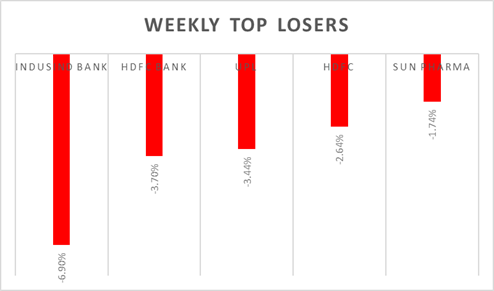

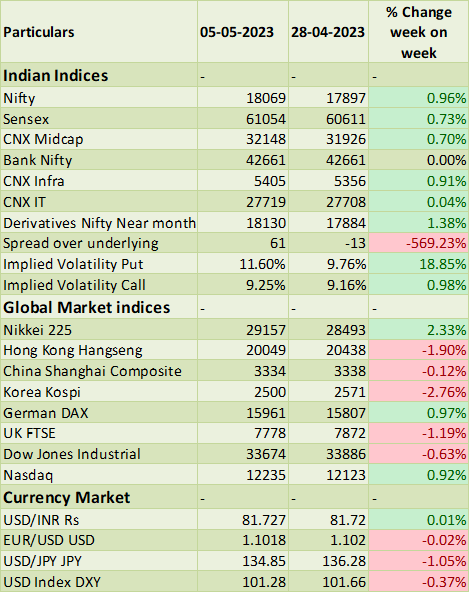

Sensex & Nifty declined sharply on Friday amid the sharp declines for HDFC companies. HDFC Bank and HDFC both lost over 5% after MSCI stated it would include the merged entity of the two companies into its large-cap index with an adjustment of 0.5 instead of market expectations of 1, driving market players to estimate an outflow of USD 150 million from the firms. Tech shares also booked losses, with Tech Mahindra, HCL Technologies, and Wipro all losing more than 1%.

In the coming week, investors will watchout for CPI from US & domestic data points and Q4 earnings from corporates. FIIs/FPIs domestic outflows stood at Rs. 37 billion YTD.

Equity Market Summary:

o Wallstreet indices gained sharply on Friday amid better than expectation NFP data boosted market sentiment which tempered fears of recession.

o European markets too closed on positive amid tracking positive cues from US market and positive corporate earnings.

o The US economy unexpectedly added 253,000 jobs in April 2023, beating forecasts of 180,000 and following a downwardly revised 165,000 in March 2023.

o Average hourly earnings for all employees on US private nonfarm payrolls rose by 0.5%, in April 2023, after a 0.3% increase in the prior month, which is fastest pace of % rise in last 9 months.

o The US trade gap narrowed to a 4 month low of USD 64.2 billion in March 2023 from USD 70.6 billion in February, compared to market forecasts of a USD 63.3 billion gap. Exports went up 2.1% and imports edged 0.3% lower.

o The Federal Reserve raised the fed funds rate by 25bps to a range of 5%-5.25% during its May policy-meeting, marking the 10th increase and bringing borrowing costs to their highest level since September 2007.

o The European Central Bank raised its key interest rates by 25 bps during its May policy-meeting, signalling a slowing pace of policy tightening.