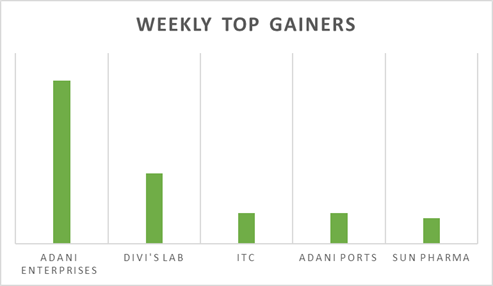

�Sensex & Nifty gained by 1%, with both indexes hitting their highest levels since December 2022. The IT sector experienced a boost because of the tech-heavy Nasdaq's sharp overnight rise, fueled by impressive earnings from a leading chipmaker Nvidia. Among individual stocks, Reliance Industries jumped nearly 3%.

The performance of the US markets after the White House reached a debt ceiling deal with Republicans to avert an imminent default will offer temporary VIX cool-off.

In the coming week, investors will watch out for US NFP Data and debt ceiling talks progress. FIIs/FPIs domestic inflows stood at Rs. 227 billion YTD. �

Equity Market Summary:

o Wall street indices surged on Friday after Treasury Secretary Yellen announced the department expects to be able to make payments on US debts up until June 5, buying time for debt ceiling talks.

o European shares staged a recovery at the end of a volatile week, bouncing back from multi-week lows on Friday.

o US economy grew by an annualized 1.3% on quarter in Q1 2023, slightly higher than 1.1% in the advance estimate and market forecasts of 1.1%.

o US 10-year Treasury note climbed above 3.83%, by stronger-than-expected personal consumption expenditures data, which raised expectations of additional tightening by the Federal Reserve.

o Profits earned by China's industrial firms dropped by 20.6% from a year earlier, amid a weakening economic recovery, feeble demand, and margin pressures.

o The number of Americans filing for unemployment benefits rose to 229,000 in the week ending 20th May 2023.

o Consumer price inflation in the UK fell to 8.7% (Y-o-Y) in April 2023, the lowest since March 2022, due to a sharp slowdown.