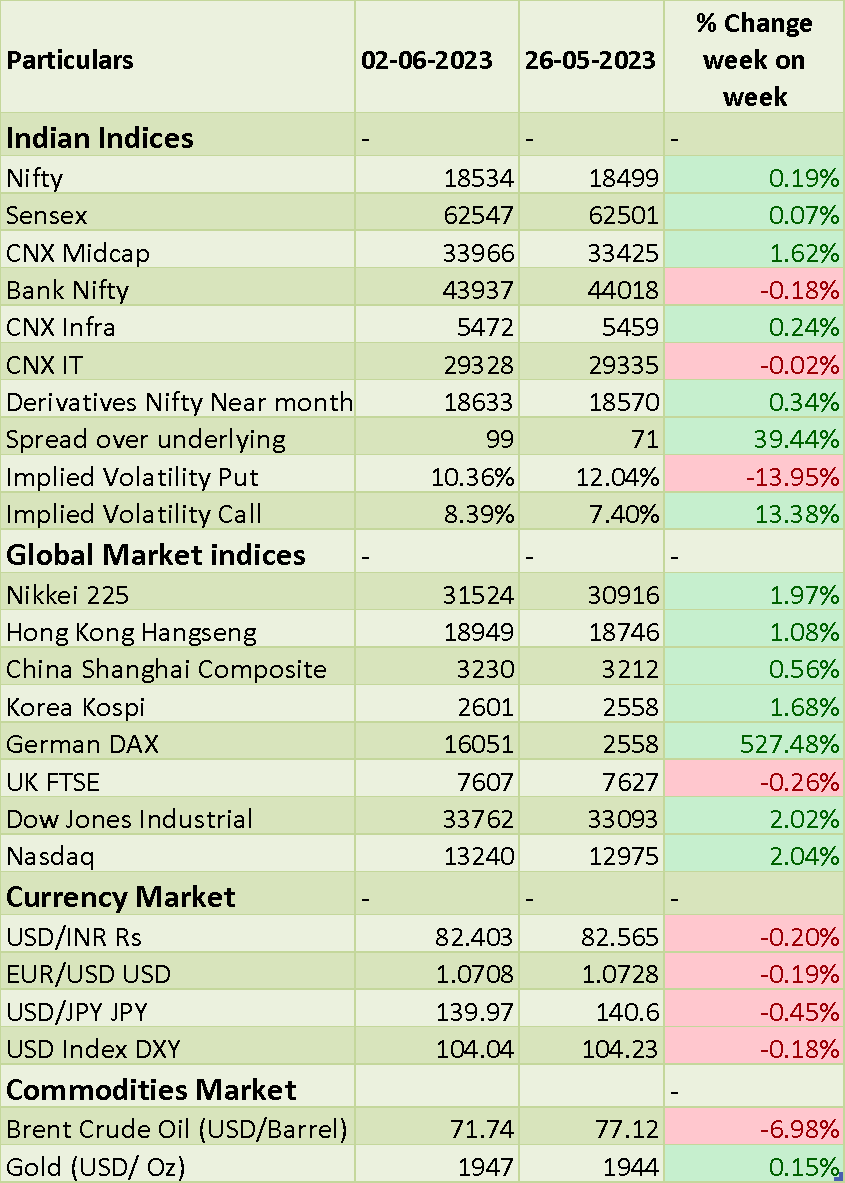

Sensex & Nifty closed positive on Friday, recovering just enough to notch a flat reading on the week as the US Congress’s approval of the debt ceiling deal and dovish signals from Fed officials supported equity benchmark worldwide. S&P Global India Manufacturing PMI increased to 58.7 levels in May 2023 from 57.2 a month earlier, exceeding market forecasts of 56.5. This was the strongest improvement in factory activity since October 2020, boosted by strength of demand.

In the coming week, investors will watch out for RBI policy-meeting outcome. FIIs/FPIs domestic inflows stood at Rs. 357 billion YTD.

Equity Market Summary:

- Dow Jones closed 2.1% higher on Friday while the S&P 500 added 1.4%, reached its highest level since August 2022 and the Nasdaq topped its April 2022 highs gaining 1%. Investors welcomed a mixed payrolls report showing hotter-than-expected payrolls white an unexpected rise in unemployment and a slowdown in annual wage growth.

- 10-year US Treasury note rose to the 3.63% mark on Friday, after domestic labor data added confusion to the expected path of US monetary policy.

- The unemployment rate in the US increased to 3.7% in May 2023, the highest since October 2022 and above market expectations of 3.5%. US economy unexpectedly added 339,000 jobs in May 2023, the most in four months, and way above market forecasts of 190,000.

- US crude oil inventories rose by 4.488 million barrels in the week ending May 26, 2023, compared with market expectations of a 1.386 million.

- European Central Bank raised its key interest rates by 25 bps during its May policy-meeting, signalling a slowing pace of policy tightening.