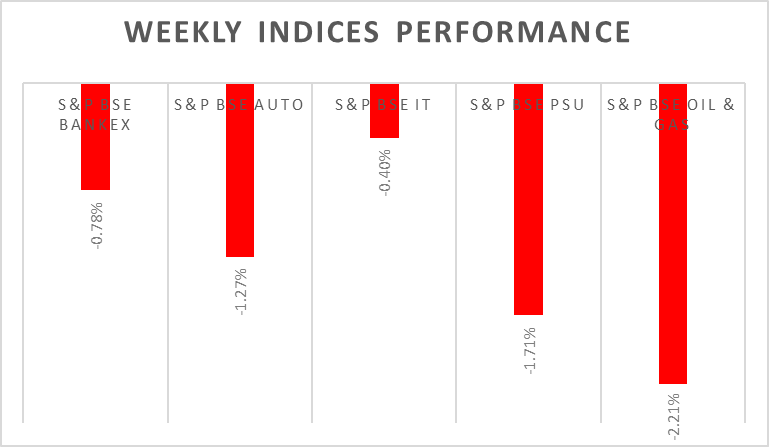

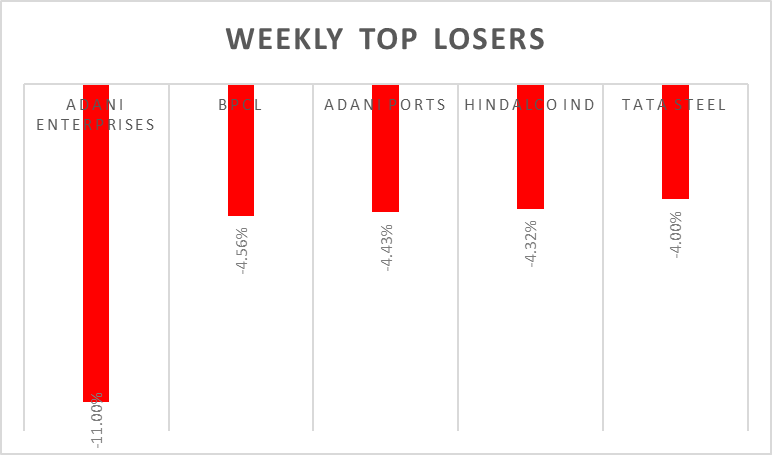

Sensex & Nifty recorded a weekly decline after 5 weeks of consecutive gains, negative global cues amid hawkish commentary from global central banks impacted the sentiment. Indices missed to register fresh record highs despite high FII/FPI inflows. On the corporate news front, NDTV reported Shree Cement accused of Rs. 230 billion of tax evasion. Markets will react to Shree Cements tax evasion reports and US SEC subpoena of Adani Enterprises. Sensex & Nifty likely to witness volatility amid negative global cues and monthly F&O expiry.

In the coming week, investors will watch out for US Q1 GDP growth and annual US bank stress results. Domestic investors will watch out for progress of southwest monsoon and Rs15 billion worth of IPO’s which will be open this week.

Equity Market Summary:

- Wallstreet indices finished lower on Friday, tracking global cues amid worries over Fed’s hawkish commentary on two more rate hikes expected before the end of this year. US future indices will react to news of a mini coup in Russia between the military and Prigozhin.

- Eurozone Services PMI fell by 1.7 points from the previous month to 52.4 levels in June 2023, pointing to the sixth consecutive month of growth.

- Japan Services Business Activity Index unexpectedly slipped to 54.2 levels in June 2023 from a record-high of 55.9 levels in May 2023.

- Annual inflation rate in Japan unexpectedly declined to 3.2% in May 2023 from April's 3-month high of 3.5%, missing market forecasts of 4.1%.

- The Bank of England raised its policy interest rate by 50bps to 5% during its June policy-meeting, marking the 13th consecutive hike.