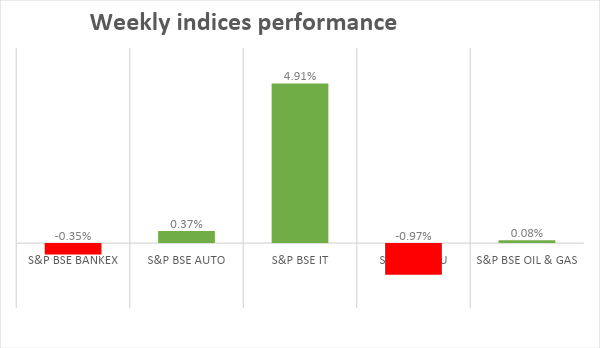

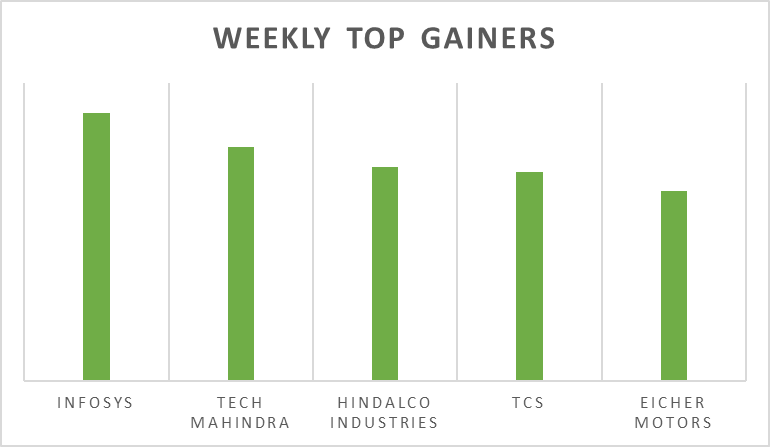

Sensex & Nifty touched fresh highs on Friday, notching a 1.1% increase on the week with support from a favourable macroeconomic. The tech sector, which is highly exposed to consumer appetite from the US and Europe, led the gains in the sector. TCS extended yesterday's strong momentum with a 5.1% surge, while Infosys added 4.5% and Tech Mahindra gained 4.3%. Strong inflows from FII/FPIs continue as for the month of July inflows stood at 306 billion.

India's merchandise trade deficit narrowed to USD 20.13 billion in June 2023 from USD 22.07 billion in the same month of the previous year.

In the coming week, investors will watch out for US companies earnings from Netflix, Tesla, IBM and Goldman Sachs. China’s Q2 GDP growth will be in focus.

Equity Market Summary:

- Wall Street closed mixed following five sessions of gains on Friday, as investors digested the latest earnings reports. Big banks earnings came in stronger-than-expected, including JPMorgan Chase, Wells Fargo and Citigroup.

- The annual inflation rate in the US slowed to 3% in June 2023, the lowest since March of 2021 and compared to 4% in May and expectations of 3.1%.

- The yield on the US 10-year Treasury was around 3.78% on Friday, close to low levels not seen since late June 2023, after both consumer and producer inflation figures came below market forecasts.

- Industrial production in Japan declined by 2.2% (M-o-M) in May 2023, compared with the flash reading of a 1.6% drop and after a final 0.7% growth a month earlier.

- Industrial production in the Euro Area rose by 0.2% (M-o-M) in May 2023, easing from a 1% increase.

- China's trade surplus fell to USD 70.62 billion in June 2023 from USD 97.41 billion in the same period a year earlier and below market forecasts of USD 74.80 billion, as exports dropped more than imports amid persistent weak demand from home and abroad.