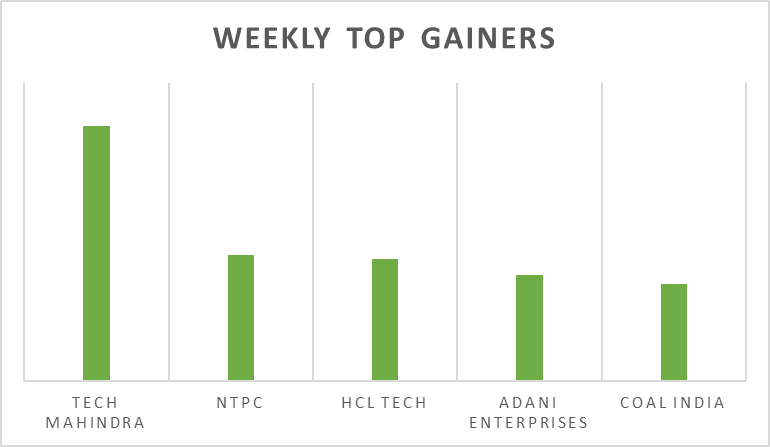

Sensex & Nifty rebounded from a 3-day losing streak and edged up 0.7% on Friday, after positive corporate results. India's largest bank, State Bank of India, reported a near 3-fold YoY growth in Q1 profit and Mahindra & Mahindra reported 2-fold profitability growth. On the macro-economic data front, India services PMI unexpectedly rose to 62.3 levels in July 2023 from June levels of 58.5. FII/FPIs outflows as of 6th August stood at Rs.20 billion.

In the coming week, global investors will watch out for US and China inflation data. Domestic investors will watch out for RBI’s monetary policy decision and inflation data.

Equity Market Summary:

- Wallstreet indices closed negative on Friday pared opening gains amid cooler job market would not prompt for further rate hikes from Fed. However, weaker earnings from Apple dragged Nasdaq.

- European equity markets closed mostly higher on Friday, after 3 consecutive days of sell-off, as upbeat earnings reports and positive U.S. job data balanced worries about slow growth in Europe. On weekly basis, DAX declined by 3%.

- US economy created 187,000 jobs in July 2023, below market expectations of 200,000 and following a downwardly revised 185,000 in June. Unemployment rate in the US decreased slightly to 3.5% in July 2023.

- US ISM Services PMI fell to 52.7 levels in July 2023 from a 4-month high of 53.9 levels in June, compared to forecasts of 53 levels.

- Japan Services PMI was at 53.8 levels in July 2023, compared with a flash print of 53.9 levels and a final 54 levels in June.