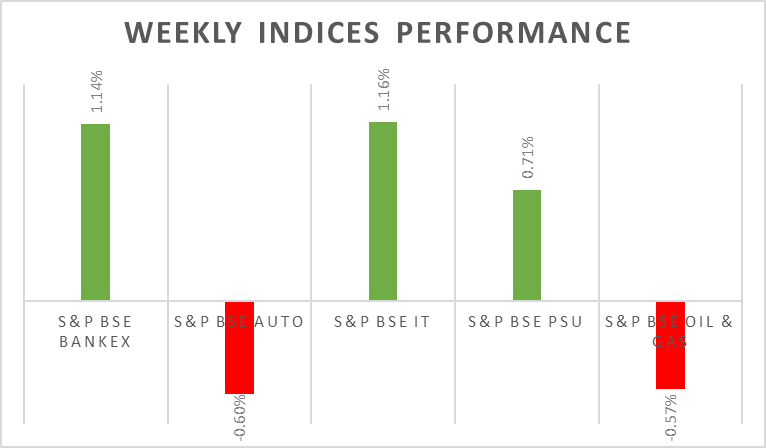

Sensex and Nifty concluded Friday 0.6% lower, marking its 5th consecutive week of decline. The drop was attributed to broad sectoral losses, driven by concerns over near-term inflation risks highlighted in the Reserve Bank of India's policy meeting minutes. Particularly, the IT and financial services sectors saw the most significant declines. The decline in domestic equities was also influenced by rising food prices and a liquidity deficit in the banking system.

Global equity markets closed on mixed note after Fed chair recent address at the Jackson Hole Symposium underscored the potential need for the US Federal Reserve to introduce further interest rate hikes.

During the upcoming week, investors will closely monitor the US Non-Farm Payrolls (NFP) and Personal Consumption Expenditures (PCE) data. These significant data points could strongly influence the decision-making process of Federal Reserve policymakers as they approach their September policy meeting.

Equity Market Summary:

- Wallstreet indices managed to close positive on Friday as investors weighed the remarks from Fed Chair Powell at the Jackson Hole Summit. Powell suggested that in September 2023, interest rates would remain unchanged to evaluate incoming data, as well as the evolving outlook and potential risks.

- S&P Global US Services PMI fell to 51 levels in August 2023 from 52.3 levels in the previous month, missing market expectations of 52.2 levels.

- Eurozone recorded a current account surplus of EUR 36.8 billion in June 2023, in contrast to a revised EUR 4.4 billion deficit in the same month the previous year.

- Japan Services PMI increased to a 3-month peak of 54.3 levels in August 2023 from 53.8 levels in July. It was the 12th consecutive month of growth in the service sector and the fastest pace since May 2023.

- US crude oil inventories fell by 6.135 million barrels in the week to18th August 2023, above market expectations for a 2.85-million-barrel draw.