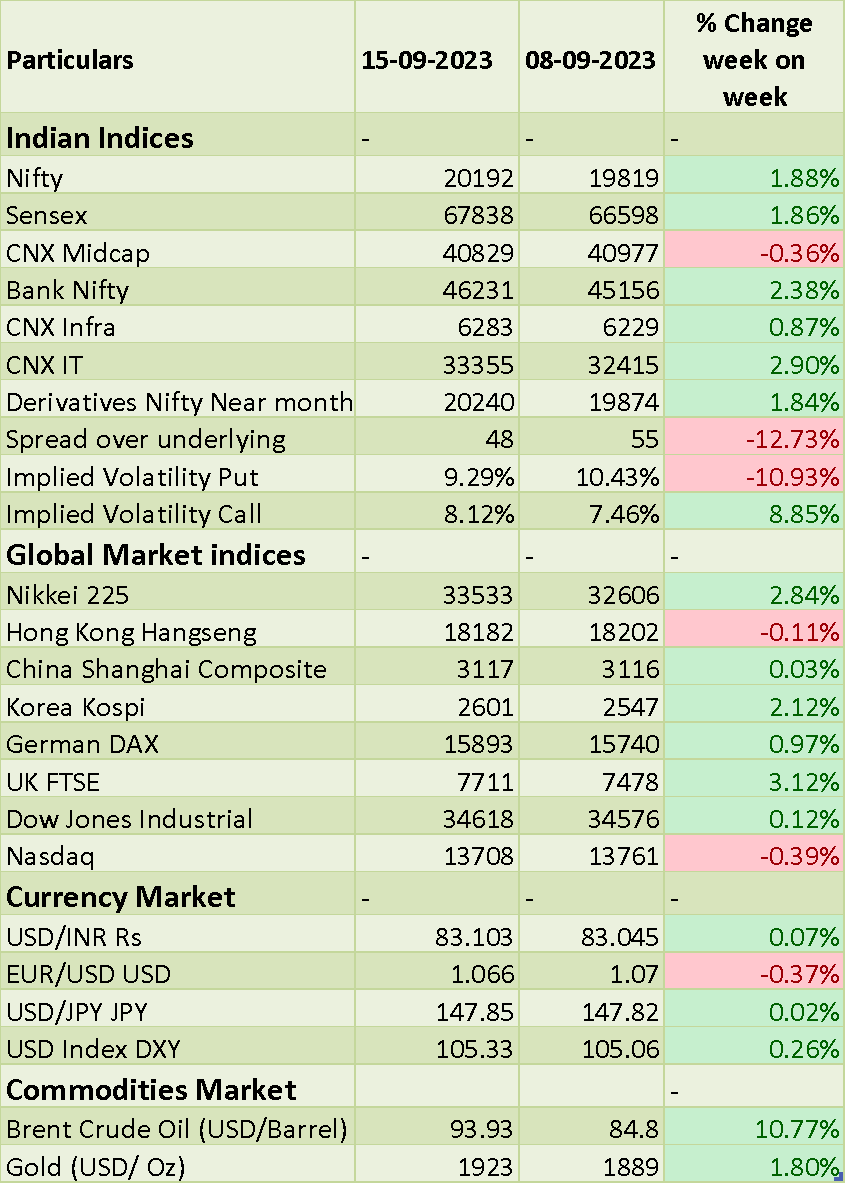

On Friday, both the Sensex and Nifty closed on a positive note, reaching fresh record highs. This marked the 11th consecutive session of gains for domestic indices, representing the longest winning streak in 16 years. Investors were encouraged by favorable data emerging from China, which had a positive impact on the global equity market.

China's industrial production and retail sales data showed robust performance, boosting market sentiment. Additionally, Chinese monetary policymakers decided to reduce the Reserve Requirement Ratio (RRR) to stimulate the domestic economy. In contrast to these moves, the European Central Bank (ECB) raised interest rates by 25 basis points to curb inflation in the previous week.

On domestic macroeconomic data front, the Consumer Price Index (CPI) eased to 6.83% in August, down from July's 7.44%, which had been the highest level since April 2022. However, the domestic trade deficit widened to USD 24.2 billion in August 2023, marking the largest gap in 10 months and surpassing market expectations of USD 21 billion. This expansion was primarily driven by rising oil prices and a weaker Indian rupee.

Looking ahead to the upcoming week, investors will be closely monitoring the Federal Reserve's policy meeting and global Purchasing Managers' Index (PMI) figures.

Equity Market Summary:

- Wallstreet indices declined more than 1% amid option expiration, tech shares were top losers. Next trigger for US indices would be Fed meeting which is on 20th September 2023.

- Manufacturing production in the US went up 0.1% from a month earlier in August 2023.

- US CPI accelerated for a second straight month to 3.7% in August from 3.2% in July, above market forecasts of 3.6%.

- China's industrial production rose by 4.5% (Y-o-Y) in August, beating forecasts of 3.9% and rose from a 3.7% increase in July.

- ECB hiked interest rates by 25bps and it is for the 10th consecutive time and signalled that it is likely done tightening policy, as inflation has started to decline.

- Brent crude futures extended gains passing USD 94 per barrel on Friday, scaling to 10-month highs amid an improving global demand outlook and tightening supplies.