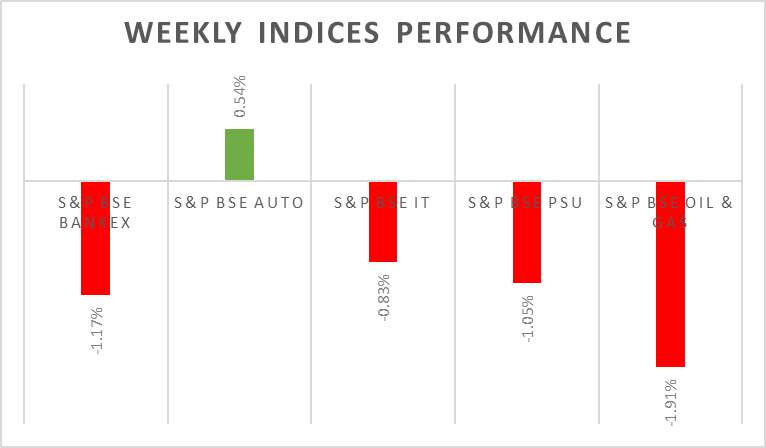

Sensex & Nifty declined by 1% amid weak negative global cues. US treasury yields touched 5% for the first time since 2007 causing fund outflows from emerging markets. FII/FPI data shows as of 22nd October 2023 outflow of Rs. 121 billion.

In the upcoming holiday-shortened week, domestic stock markets are set to be influenced by quarterly earnings, global trends, and fluctuations in crude oil prices. The ongoing Hamas-Israel conflict in the Middle East will be closely watched, alongside foreign investors' trading activities. Expect potential volatility due to the monthly derivatives expiry on Thursday. Key earnings reports will be announced by Reliance Industries, Asian Paints, and BPCL during the week.

In the upcoming week, investors will closely US GDP data, PMI readings, and US tech giant earnings.

Equity Market Summary:

- Major US stock indices closed in the negative territory on Friday, as unrest in the Middle East, rising yields and mixed earnings weighed on market sentiment.

- Fed is proceeding carefully and policymakers will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks, Fed Chair Powell said at the Economic Club of New York.

- Euro Area posted a current account surplus of EUR 30.67 billion in August 2023, compared to a deficit of EUR 26.57 billion in the same period of the previous year.

- Annual inflation rate in Japan fell to 3.0% in September 2023 from 3.2% in the prior month, pointing to the lowest reading since September 2022.