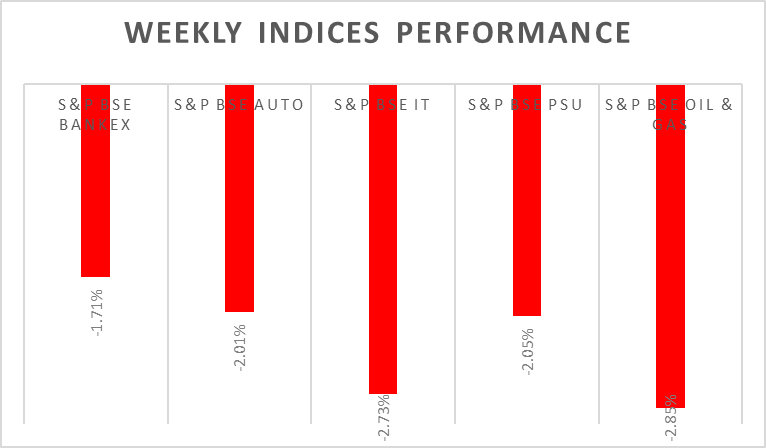

Sensex & Nifty rebounded by 1% to reach on Friday, breaking a 6-day losing streak, as investors were digesting a batch of healthy corporate results. However, the gains on Friday were not enough to avoid a 2.5% weekly loss in the Sensex & Nifty, as tensions in the Middle East and high global bond yields weighed on the market throughout the week. FIIs/FPIs outflows for the month of October stood at Rs. 203 billion. Domestic primary markets would be raising funds worth Rs. 37 billion in the upcoming week.

In the upcoming week, investors will closely monetary policy decisions from US, UK & Japan, GDP growth data from Euro Area and PMIs of China & India.

Equity Market Summary:

- On Friday, Wall Street indices experienced a decline as personal consumption and spending data exceeded market expectations, prompting a rapid sell-off across the broader financial markets. These data points hold significant importance in the upcoming Federal Reserve policy meeting's decision-making process.

- Core PCE prices in the US, which exclude food and energy, increased by 0.3% from the previous month in September of 2023, the most in 4 months.

- Profits earned by China's industrial firms fell by 9% Y-o-Y in the 9 months of 2023, slowing from an 11.7 % slump in the prior period.

- US economy expanded an annualized 4.9% in the third quarter of 2023, the most since the last quarter of 2021, above market forecasts of 4.3%.

- ECB kept interest rates at multi-year highs during its October policy-meeting, marking a significant shift from its 15-month streak of rate hikes.

- Crude oil inventories in the US rose by 1.371 million barrels in the week ending 20th October 2023, after a 4.491 million draw in the previous period.