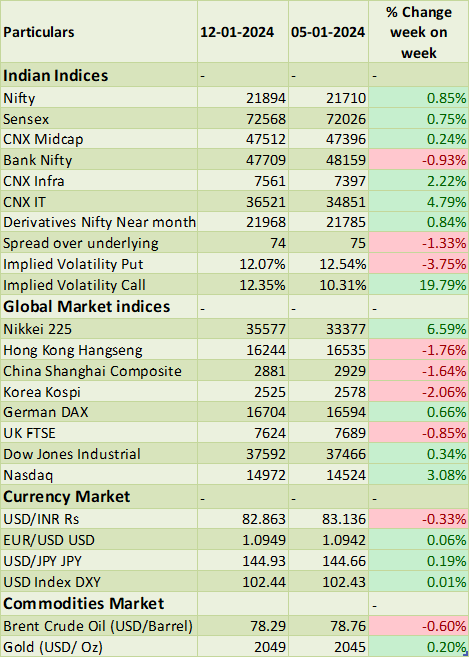

Global market momentum was significantly influenced by inflation data, with the US CPI rising to 3.4%, surpassing both previous figures and market expectations. Concurrently, India's CPI recorded a modest increase to 5.69%, aligning closely with the Reserve Bank of India's targeted zone. The release of the US CPI data triggered a correction in US markets, compounded by subdued earnings reports from banks, leading to a notable decline on Friday.

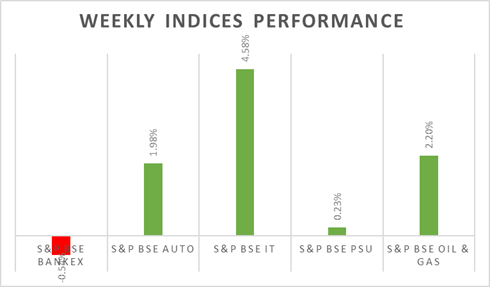

In contrast, the Indian stock market painted a different picture as Sensex and Nifty reached record highs. This surge was attributed to the rally in technology stocks, which witnessed gains ranging from 4% to 7% on Friday. These tech stocks, being heavyweight components of the indices, played a pivotal role in propelling the markets to unprecedented levels.

On the macroeconomic front, India's industrial production exhibited a slowdown, registering a YoY growth of 2.4% in November 2023, marking the lowest reading since March 2023.

Additionally, Foreign Institutional Investors (FIIs)/Foreign Portfolio Investors (FPIs) displayed a positive sentiment, with domestic inflows reaching Rs. 38 billion as of January 14, 2024.

In the upcoming week, investors will closely watch for GDP growth data from China and quarterly earnings from US and Indian corporates.

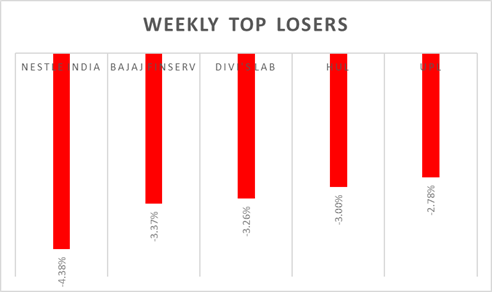

Equity Market Summary:

� Wallstreet indices closed on negative on Friday amid corporate earnings released came in softer than market expectation. Bank of America, JP Morgan and Wells Fargo declined by more than 1% on Friday.

� Annual inflation rate in the US went up to 3.4% in December 2023 from a 5-month low of 3.1% in November, higher than market forecasts of 3.2%.

� European stocks closed higher on Friday, supported by expectations of looser monetary policy as ECB President Lagarde noted in an interview that interest rates in the Eurozone are likely to have peaked and outlook on inflation pressure seemed to be eased.

� Japan's service sector confidence was up by 1.2 points from the prior month to 50.7 levels in December 2023, beating market forecasts of 49.9 levels.

� China's trade surplus increased to USD 75.34 billion in December 2023 from USD 70.65 billion in the same period the previous year, surpassing market forecasts of USD 74.75 billion. Exports and imports increased by 2.3% and 1.7% respectively.