The government kept to its budgeted borrowing plan for fiscal 2020-21, as it released the 2nd half borrowing program. The borrowing program size was increased in April 2020 on Covid led lockdown. Bond markets were nervous on higher than expected borrowing for the 2nd half but were provided relief by the government.

The borrowing is clearly understated given the decline in government revenues with tax revenues down by 25% to 30% from budgeted levels. Non tax revenues are also expected to be down, as the disinvestment target of Rs 2.1 trillion is not likely to go through. Spending is high on the funds given to the agriculture sector and on covid relief to the population. Borrowing will be more in the 4th quarter of this fiscal year and will stay high for the next fiscal year as well.

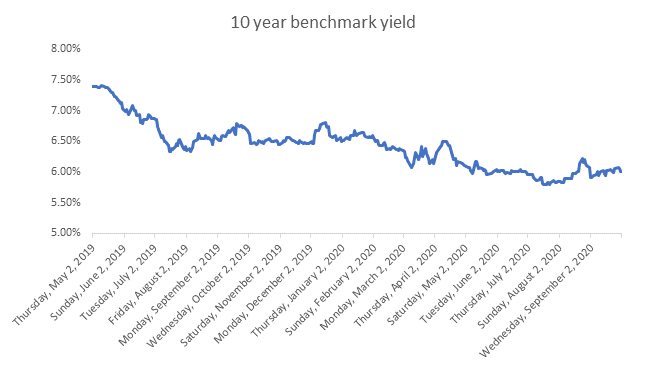

Bond yields fell marginally on the government borrowing announcement and on RBI trying to keep a lid on yields through bond auction devolvements and operation twist. RBI postponed its October policy meeting and has not given the rescheduled dates. The central bank is unlikely to cut rates further given inflation running at over 6% levels but will do what it takes to keep down bond yields.

Bond market will be cautious into the policy and yields could stay ranged but over the longer term, yields will move higher on sustained high government borrowing.

In the second half of fiscal year 2020-21, Union Government will borrow Rs 4340 billion, which is 36.17% of the budgeted borrowing for full fiscal year. During first half, Government has borrowed Rs 7660 billion and net borrowing was at Rs 6354.28 billion.

From October 1st, 2020 to March 31st, 2021 RBI is scheduled to conduct 16 weekly auctions for government securities of Rs 270-280 billion.

The issuance in the 2 years maturity category is expected to be around 5.53% of total issuance , 5 years maturity category is expected to be around 14.74% , in the 10 years maturity category around 22.35%, in the 14 years maturity category around 22.12%, in the 30 years maturity category around 13.13%,in the 40 years maturity category around 16.59 %and Floating rate category around 5.53.

The government will issue different types of instruments having non-standard maturities and Floating Rate Bonds, including CPI linked inflation-linked bonds, depending upon the requirement. RBI will also conduct switches of securities operation through an auction on every third Monday of the month. Government of India has also kept the right to exercise the green-shoe to retain additional subscription up to Rs 20 billion for security-wise for second half of 2020-21, under Green Shoe option.

Regular government borrowing is in addition to bond switches where the government will buy short end and issue long end bonds to elongate the maturity of debt and helps relieve stress on near term bond maturity repayments.

A total of four securities amounting to Rs 933.38 billion are coming up for redemption. On 10th December, 8.12% 2020 outstanding Rs 494.93 billion, on 21st December 2020, FRB 2020 outstanding Rs 130 billion, on 27th December 2020 ,11.60% 2020 outstanding Rs 50 billion, on 21st January 20210 ,7.00% 2021 outstanding Rs 291.45 billion will be redeemed.

Second half borrowing of the Government of India is expected to be completed by January 2021 to help generate sufficient space to manage the borrowing of the State Governments smoothly. During Oct-Dec 2020, state government are likely to borrow Rs 2022.42 billion. During Apr-Sep 2019, state government have borrowed Rs 3266.59 billion.