Currency Market Snapshot for The Week

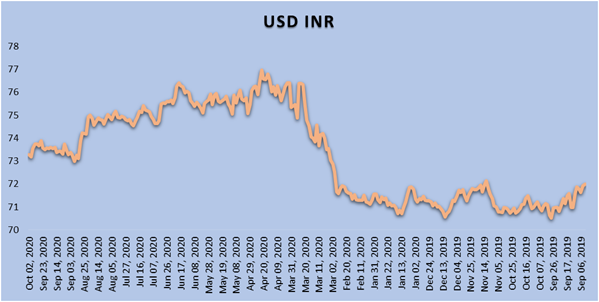

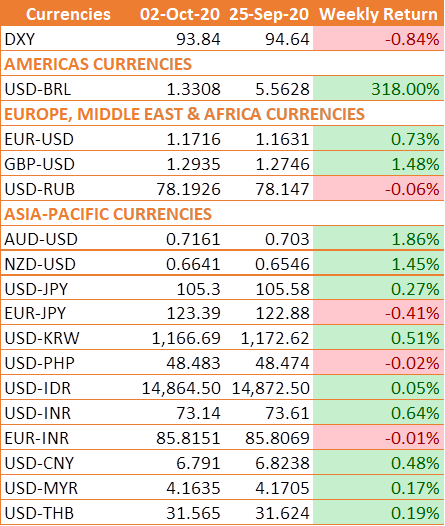

- INR appreciated by 0.64% against the USD last week and marginally depreciated by 0.01% against the euro.

- USD fell by 0.84% on a week on week basis and is at a level of 93.84.

- The British pound appreciated by 1.48% against the USD

- Euro appreciated by 0.73% against the USD.

Global Bond Market Snapshot for The Week

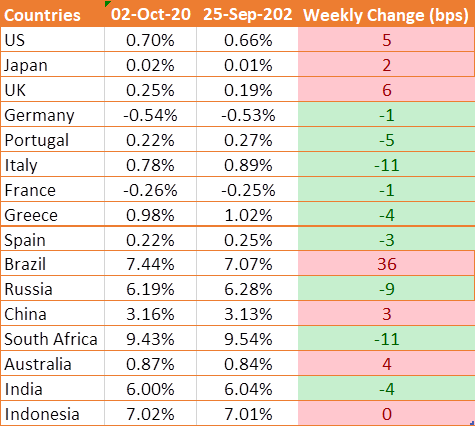

- US 10-year benchmark bond yield rose by 5 bps to 0.70% last week.

- German 10-year bond yield fell by 1 bps and is at negative 0.54%.

- Italy's 10-year benchmark yield fell by 11 bps to 0.78%.

- US benchmark Junk bond yields fell by 26 bps and is at 5.73%

INR ended the week higher against USD last week as the demand was largely buoyed by foreign investments into a slew of Indian companies. INR appreciated by 0.64% against the USD last week and marginally depreciated by 0.01% against the euro.

Domestic data released during the week showed that India�s current account surplus jumped to an all-time high of USD 19.8 billion (3.9% of GDP) for the April-June 2020 period due to collapse in imports. Lower imports in the first quarter of FY21 resulted in the trade deficit narrowing to a 15-year low of USD 10 billion.

Additionally, India�s external debt stood at USD 554.5 billion at end-June, recording a decrease of USD 3.9 billion over its level at the end of March 2020. Further, the external debt to GDP ratio increased to 21.8% at June-end 2020 from 20.6% as on March 31.

USD ended the week lower against major world currencies last week as the global risk sentiment improved due to growing hopes of a fresh stimulus package in the US. However, the sentiment weakened on Friday after U.S. President Donald Trump tested positive for the Covid-19 virus. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.85% and is at a level of 93.84.

The renewed optimism for a new Covid relief package has been based on comments from U.S. Treasury Secretary Steven Mnuchin, who said that Wednesday talks with House Speaker Nancy Pelosi had made progress, prompting the House of Representatives to postpone a vote on a Democratic coronavirus plan to allow more time for a bipartisan deal to come together.

Mnuchin said later that he would not accept the Democrats' proposed USD 2.2 trillion aid package, rather something closer to USD 1.5 trillion, adding that an agreement had been reached on direct payments to U.S. citizens.

Moreover, data released on Wednesday showed that Chicago purchasing managers' index unexpectedly surged to 62.4 in September, marking the highest level since December 2018. The reading stood at 51.2 in the previous month. Separately, the number of jobs in the private sector rose by 749,000 in September, suggesting that the US labor market is expanding gradually.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yield rose by 5 bps last week and is at 0.70% amid expectations that Congress could still strike a deal on another fiscal stimulus bill, following President Donald Trump�s diagnosis of COVID-19.

Eurozone bond yields fell last week. German 10-year bond yields fell by 1 bps to negative 0.54%, France 10-year bond yields fell by 1 bps to negative 0.26%. Italy�s 10-year bond yield fell by 11 bps to a level of 0.78%.

US benchmark Junk bond yield fell by 26 bps to 5.73%, Euro benchmark Junk bond yields fell by 10 bps to 4.96%.