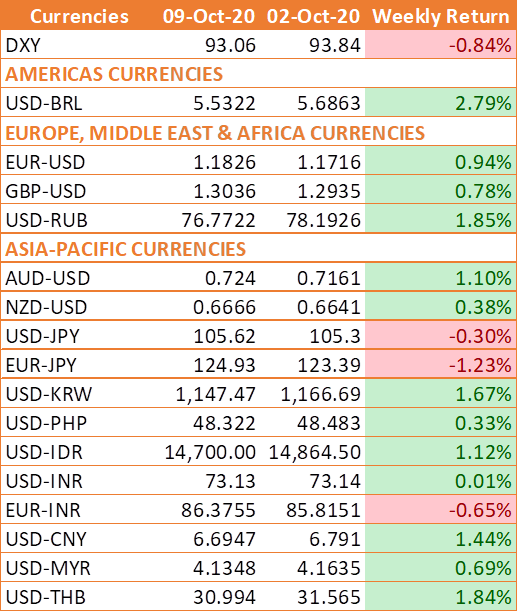

Currency Market Snapshot for The Week

- INR appreciated by 0.01% against the USD last week and depreciated by 0.65% against the euro.

- USD Index fell by 0.84% on a week on week basis and is at a level of 93.06

- The British pound appreciated by 0.78% against the USD

- Euro appreciated by 0.94% against the USD.

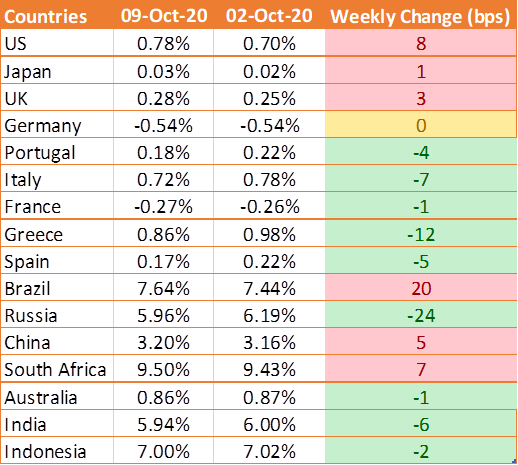

Global Bond Market Snapshot for The Week

- US 10-year benchmark bond yield rose by 8 bps to 0.78% last week.

- German 10-year bond yield was flat at negative 0.54%.

- Italy's 10-year benchmark yield fell by 7 bps to 0.72%.

- US benchmark Junk bond yields fell by 34 bps and is at 5.39%

INR ended the week marginally higher against USD last week amid improvement in the appetite for riskier assets across the globe and due to persistent foreign fund inflows for investments into Indian entities. However, the gain remained capped as RBI intervened in the currency market to avoid sharp INR appreciation. INR appreciated by 0.01% against the USD last week and depreciated by 0.65% against the euro.

Media reports over the weekend said GIC will invest a total of RS 55.12 billion into Reliance Retail Ventures, and TPG will invest Rs 18.37 billion. The total amount stands at a little over USD 1 billion at the prevailing exchange rate.

USD fell against major world currencies for the second consecutive week over persistent stimulus hopes. Further, market participants were also relieved on US President Donald Trump's return to the White House ahead of the US presidential elections. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.84% and is at a level of 93.06.

The US President is being treated for COVID-19 after he tested positive last week. With Trump testing positive, market had turned jittery about the political situation in the world's largest economy ahead of the US presidential elections scheduled for Nov 3.

On Wednesday, US President Donald Trump, in an unprecedented move, called off discussions over a coronavirus stimulus package making markets jittery again. However, House of Representative Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin resumed talks to discuss the measures, defying President Donald Trump's ban.

On Tuesday, US Federal Reserve Jerome Powell warned of risks to the economy if COVID-19 is not effectively controlled. Powell also called for more economic assistance which soothed the market's jitters as Trump's comments was perceived as an indication that the fiscal package in the US will be delayed and not overruled regardless of whoever-Trump or Democrat nominee Joe Biden--wins the election.

The latest opinion polls suggest US citizens are steadily losing confidence in President Donald Trump's handling of the coronavirus pandemic, with his net approval on the key issue this election hitting a record low in a new Reuters/Ipsos poll. With this in mind, and with Trump refusing to take part in the next presidential debate scheduled virtually for next week, market participants are starting to factor in Democrat candidate Joe Biden winning the White House and adjusting their thinking as to what that means for additional stimulus.

Weekly Global Bond Market AnalysisUS 10-year benchmark bond yield rose by 8 bps last week and is at 0.78% after the minutes of the Federal Reserve's September policy meeting showed that the Fed would not tweak its asset purchases to buy more longer-dated debt. Additionally, the high hopes for stimulus package irrespective of election outcome improved risk sentiment driving yields higher.

Eurozone bond yields fell last week. German 10-year bond yields remain flat to negative 0.54%, France 10-year bond yields fell by 1 bps to negative 0.27%. Italy's 10-year bond yield fell by 7 bps to a level of 0.72%.

US benchmark Junk bond yield fell by 34 bps to 5.39%, Euro benchmark Junk bond yields fell by 17 bps to 3.78%.