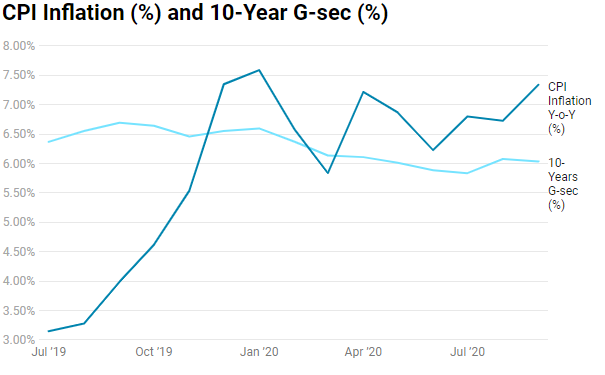

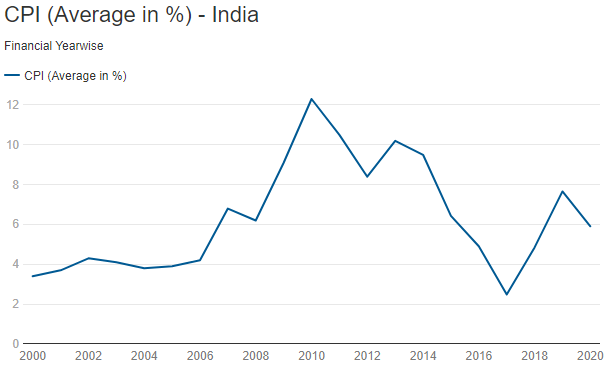

Inflation is much higher than RBI managed interest rates and this can lead to macro economic instability as real negative rates hurts private savings and also leads to currency depreciation that will cause outflows of capital. Low rates at times of rising inflation will lead to excessive debt in the economy as government and corporates get cheap money and this can lead to inflation trending higher.

In September 2020, CPI rose to 7.34% from 6.69% in the previous month. Consumer Food Price Index (CFPI) 10.68% higher against previous year. Clothing and footwear, Housing, Fuel and light inflation rose slow pace at 3.04%,2.83% and 2.87% respectively. Core inflation was at 5.7%.

RBI policy review for October 20 was all about protecting bond yields from rising so that government borrowing can go through smoothly. Interest rates were maintained status quo though GDP growth forecast for this year is negative while CPI inflation is expected to come off to closer to target levels of 4% from current levels of over 6%.

RBI Governor, Shaktikanta Das spent most of the policy review time on talking about and enumerating measures to make the government borrowing go through smoothly, which means that bond yields will be kept down so that government can borrow at lower interest rates. The measures for protecting bond yields include Open Market Operations for buying bonds and also simultaneous purchase and sale of bonds (sell short end and buy long end bonds), buying state development loans, increasing the SLR rate of banks and extending the period for maintaining higher SLR and providing liquidity on call to markets at lower levels of yields.

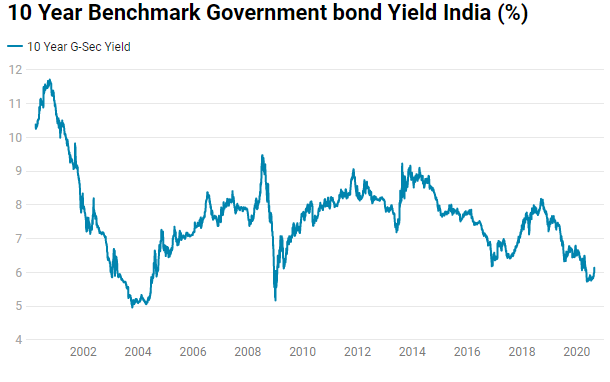

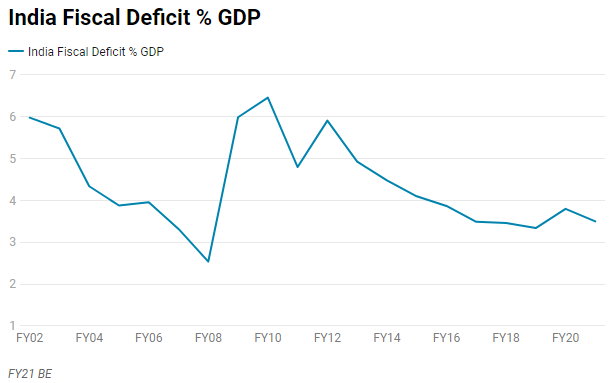

The question to ask is, while RBI is forcing bond yields to stay low despite continued high supply of bonds from government borrowing, how long can this sustain. The movement of bond yields over the last 20 years suggests that yields tend to rise sharply from below 6% levels, largely driven by higher inflation expectations due to either excess liquidity or very high fiscal deficit. If this scenario plays out, investors holding long maturity bonds will see high price erosion as yields rise.

Liquidity measures by RBI in October policy 2020

RBI decided to conduct on tap TLTRO with tenors of up to three years for a total amount of up to Rs 1 trillion at a floating rate linked to the repo rate up to full FY21. Liquidity availed by banks under the scheme has to be deployed in corporate bonds, commercial papers, and non-convertible debentures issued by the entities in specific sectors, scheme can also be used to extend bank loans and advances to these sectors.

SLR holdings in HTM limits of 22% extended upto FY22. HTM limits would be restored from 22% to 19.5%in a phased manner starting from the Q1FY22. RBI to conduct open market operations (OMOs) in SDLs as a special case during H2FY21.

Charts Data Source RBI,MOSPI,GoI