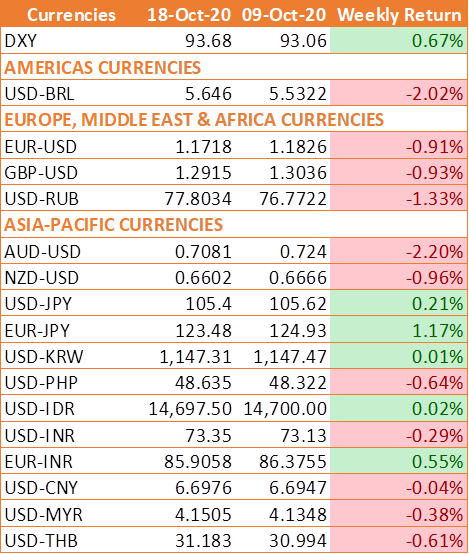

Currency Market Snapshot for The Week

- INR depreciated by 0.29% against the USD last week and appreciated by 0.55% against the euro.

- USD Index rose by 0.67% on a week on week basis and is at a level of 93.68

- The British pound depreciated by 0.93% against the USD

- Euro depreciated by 0.91% against the USD.

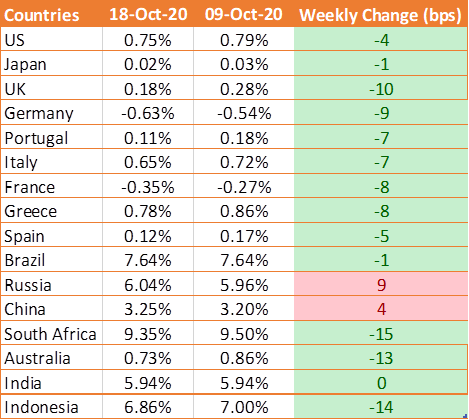

Global Bond Market Snapshot for The Week

- US 10-year benchmark bond yield fell by 4 bps to 0.75% last week.

- German 10-year bond yield fell by 9 bps to negative 0.63%.

- Italy's 10-year benchmark yield fell by 7 bps to 0.65%.

- US benchmark Junk bond yields fell by 3 bps and is at 5.42%

INR ended the week lower against USD last week after IMF forecast that the Indian economy would contract by -10.3% this year after being severely hit by the coronavirus lockdown. However, the IMF was upbeat regarding its recovery saying that India was well placed to start recovering from the crisis with the support from fiscal and monetary policy.

India's CPI inflation for September came in at 7.34% remaining well above RBIs tolerance band for sixth consecutive month. August retail inflation was 6.69%. INR depreciated by 0.29% against the USD last week and appreciated by 0.55% against the euro.

USD traded higher against major world currencies last week as demand for safe haven assets rose after the number of global COVID-19 cases continued to surge and the U.S. Congress’ stalled passing the latest stimulus measures ahead of the Nov. 3 presidential election. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.67% and is at a level of 93.68.

The impasse over the U.S. stimulus measures continued, with Treasury Secretary Steve Mnuchin warning on Wednesday that “Getting something done before the election and executing on that would be difficult.” Mnuchin added that he and House of Representative Speaker Nancy Pelosi remain “far apart” on their spending priorities. With the election only weeks away, investors’ risk aversion gave the USD a short-term boost.

Further, the risk appetite weakened after Eli Lilly placed its coronavirus antibody test on hold due to potential safety concerns, less than a day after Johnson & Johnson paused its Covid-19 vaccine trial because of a participant’s unexplained illness.

The coronavirus continued to tighten its grip on the Western world, with Europe, in particular is hard hit by a second wave. Many countries are now widening restrictions to try to regain a grip on the pandemic.

Meanwhile the Oct. 15 Brexit deadline set by Prime Minister Boris Johnson passed with no agreement. According to an EU spokesman, talks ended with Johnson telling his nation to prepare for a no-deal Brexit.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yield fell by 4 bps last week and is at 0.75% amid surge in the demand for safe haven assets as global risk sentiment weakened. The re-acceleration of COVID-19 infections in Europe is prompting eurozone government officials to institute lockdowns measures to curb the spread of the disease.

Eurozone bond yields fell last week. German 10-year bond yields fell by 9 bps to negative 0.63%, France 10-year bond yields fell by 8 bps to negative 0.35%. Italy’s 10-year bond yield fell by 7 bps to a level of 0.65%.

US benchmark Junk bond yield rose by 3 bps to 5.42%, Euro benchmark Junk bond yields rose by 4 bps to 3.82%.