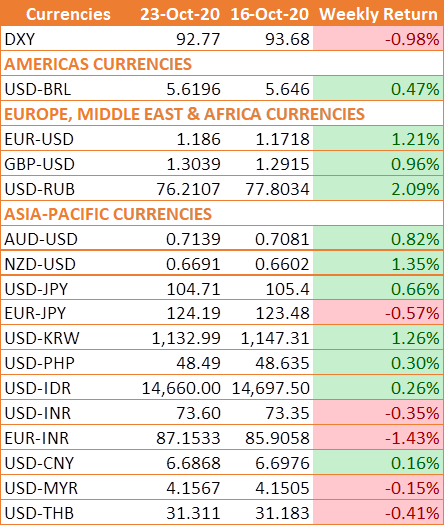

Currency Market Snapshot for The Week

- INR depreciated by 0.35% against the USD last week and depreciated by 1.43% against the euro.

- USD Index fell by 0.98% on a week on week basis and is at a level of 92.77.

- The British pound appreciated by 0.96% against the USD

- Euro appreciated by 1.21% against the USD.

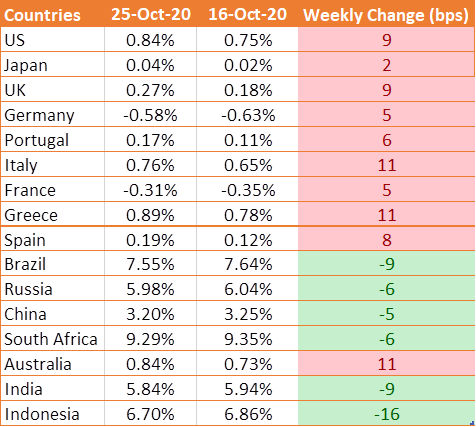

Global Bond Market Snapshot for The Week

- US 10-year benchmark bond yield rose by 9 bps to 0.84% last week.

- German 10-year bond yield rose by 5 bps to negative 0.58%.

- Italy's 10-year benchmark yield rose by 11 bps to 0.76%.

- US benchmark Junk bond yields fell by 8 bps and is at 5.34%

INR ended the week lower against USD last week despite improvement in the global risk sentiment as RBI bought USD to prevent sharp appreciation of INR. The RBI has stood in the way of INR appreciation for the past couple of months and absorbed most USD inflows of foreign investments into Indian companies and assets. Since the beginning of September, the RBI has added USD 13.69 billion to its foreign exchange reserves, taking it to a record high of USD 555.12 billion as on Oct 16. INR depreciated by 0.35% against the USD last week and depreciated by 1.43% against the euro.

USD traded lower against major world currencies last week as global risk sentiment improved after US House of Representatives Speaker Nancy Pelosi reportedly said she is optimistic about the legislation on fresh relief package to be pushed through before the presidential election in early November. Moreover, rising hopes of a win for Democratic nominee Joe Biden in the presidential elections also underpinned the sentiment.

USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.98% and is at a level of 92.77.

On Tuesday, President Donald Trump signaled that he was willing to accept a package with a larger price tag despite Republican opposition. House of Representatives Speaker Nancy Pelosi also was hopeful that the Republican-Democrat gap on the stimulus measures’ price tag is narrowing, saying, “I hope so. That is the plan,” for an agreement to be reached the following week.

On Friday, USD eased some pressure after the final presidential debate between U.S. President Donald Trump and Joe Biden ahead of the Nov. 3 election.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yield rose by 9 bps last week and is at 0.84% as data showed a fall in weekly jobless claims and lawmakers sparked renewed hopes for a coronavirus relief package deal, bolstering confidence of a economic recovery.

U.S. labor market continued to recover, with first-time applications for unemployment benefits in the latest weekly period coming in at 787,000, the lowest since March, from 842,000. Continuing claims dropped by 1.02 million to 8.37 million.

Existing-home sales increased for the fourth consecutive month in September, rising 9.4% from August to a seasonally adjusted, annual rate of 6.54 million. Meanwhile, the Conference Board’s leading economic index rose 0.7% this month.

Eurozone bond yields were mixed last week. German 10-year bond yields fell by 5 bps to negative 0.58%, France 10-year bond yields rose by 5 bps to negative 0.31%. Italy’s 10-year bond yield rose by 11 bps to a level of 0.76%.

US benchmark Junk bond yield fell by 8 bps to 5.34%, Euro benchmark Junk bond yields fell by 7 bps to 3.75%.