US Elections 2020 results have not been announced yet. Democratic candidate Joe Biden is leading Republican nominee, President Donald Trump, in terms of electoral votes. Markets are factoring in Biden's Win in USA Election 2020 as he is inching towards the majority of 270 mark.

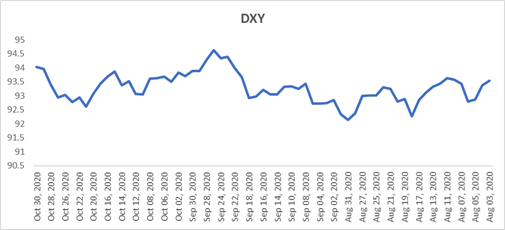

USD to weaken and UST yields to stay low

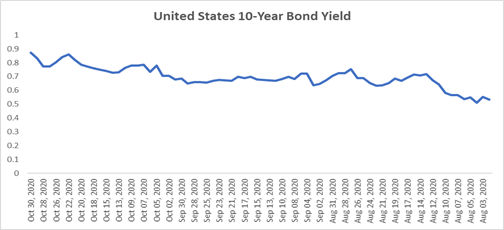

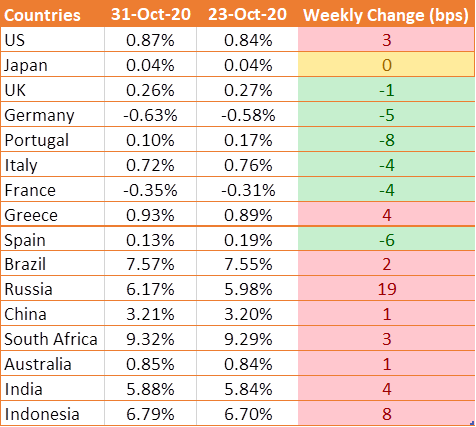

Irrespective of who wins the elections in US, the Fed will keep its money printing press fully open till such time the FOMC sees a sustained recovery in jobs and inflation staying over 2% for a while. Given the fresh lockdown in Europe due to second wave of covid and the vaccine is far from ready, both economic recovery and inflation will take a while to reach Fed targets.

Risk off trading

USD will continue to stay weak and UST yield curve is more likely to flatten than steepen.

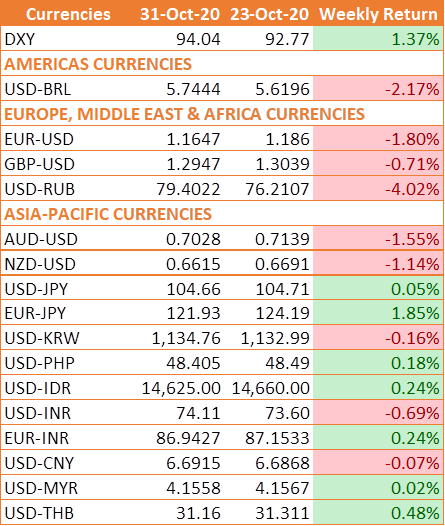

INR fell against USD across the week in risk off trading. Rising COVID cases across the globe and no US fiscal stimulus have unnerved investors prompting a move out of riskier assets and currencies, such as the INR towards safe havens such as the USD. On the domestic front, expectation of another stimulus package is doing round and that could also weigh on the INR. Market participants are waiting for more clarity on the same and that could keep the volatility in check.

Most of the major currencies traded lower against the USD last week ahead of the most closely watched elections ever, investors are reducing their positions in anticipation of big market moves. Investors believes that it's a tight race with an outcome that may not be known until weeks after Nov. 3, which will keep the financial markets especially the currencies highly volatile.

While the U.S. election will be the No. 1 focus next week, there are also three central bank meetings and U.S. labor market reports. The Federal Reserve and the Bank of England are expected to leave interest rates unchanged, but there is growing belief that the Reserve Bank of Australia will lower interest rates.

ECB Policy Outcome

The ECB kept interest rates steady on Thursday but acknowledged that the fallout from the second wave of coronavirus infections had damaged the economic outlook. The ECB sent strong signals that another easing package would be in store in December, as the economic outlook has darkened notably. The ECB's stance leaves some more room for bond yields and EUR/USD to fall further.

UST Yields Rise

US 10-year benchmark bond yield rose ahead of the November presidential election, amid growing anticipation of a victory by Democratic candidate Joe Biden. A strong mandate for presidential candidate Joe Biden could draw out a more aggressive fiscal spending package next year, bolstering economic growth and inflation expectations.