USA Elections 2020 results have not been announced yet. Democratic candidate Joe Biden is leading Republican nominee, President Donald Trump, in terms of electoral votes. Markets are factoring in Biden's Win in USA Election 2020 as he's inching towards the majority of 270 mark.

Weak USD will raise liquidity flows and bring in inflation

USD is expected to weaken irrespective of election outcome, as the Fed will continue printing money. Low UST yields will prompt global liquidity to search for higher yielding currencies, driving flows into India.

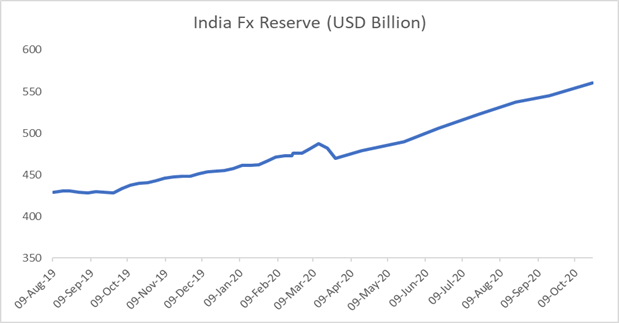

RBI will keep buying USD and shoring up fx reserves and liquidity will stay high in the system, driving up inflation expectations. Higher inflation coupled with rising fiscal deficit will push up g-sec yields, as RBI will, at some point of time, let go of holding rates down.

Government bonds, SDL and OIS yield movements

During the week, the 5.77% 2030 yield increased by 4 bps to 5.88%, while 5.79% 2030 bond yield rose by 2 bps to 5.89%. 6.45% 2029 bond yield gained by 2 bps to 5.97%. 5-year benchmark 5.22% 2025 yield increased by 4 bps to 5.17%. 6.57% 2033 yield remained unchanged at 6.235. 6.19% 2034 yield level rose by 2 bps to 6.23%. On the other hand, long term paper 7.16% 2050 yield declined by 10 bps to 6.63%.

The spread of 10-year bond over 5-year bond (5.22% 2025) came down to 72 bps from 74 bps. The 15-year benchmark over 10-year benchmark spread decreased to 34 bps from 36 bps. 30-year benchmark over 10-year benchmark spread declined to 79 bps from 83 bps.

During SDL auction conducted last week, average 10-year SDL yield stood at 6.45% as compared to 6.55% in previous week.

On weekly basis, 1-year OIS yield came down by 10 bps to 3.62% while 5-year OIS yield declined by 8 bps to 4.32%.