The government is facing a revenue shortfall that could exceed well over Rs 2 trillion on the back of a big bang corporate tax rate cut and falling direct tax and GST revenue growth due to the economic slowdown. Over and above that the government has deferred spectrum fees to be paid by telecom companies for an amount of Rs 423 billion, which will hit current year revenues for the government. The states too are demanding GST compensation for around Rs 300 billion, which has yet to be paid.

The government is planning to sell stakes in BPCL, Shipping Corporation of India and Container Corporation of India to achieve its disinvestment target of Rs 1.05 trillion. The stake sales can fetch around Rs 650 billion. The government has already disinvested Rs 176 billion this fiscal year so far. Any delay in these stake sales will dent its revenue targets further.

Given the sharp growth downtrend in revenue collections, the fiscal gap will widen and the government will have to access the bond market to bridge the gap. The fact that inflation is around 4.6% for headline CPI and less than 1% for WPI, the nominal GDP growth will be lower than the budgeted target of 11.5% and this can work to balloon the fiscal deficit to GDP ratio, which is forecast at 3.3%.

In all fronts, the extra borrowing, higher fiscal deficit to GDP ratio and continuing weak economy will work to hurt the INR and capital flows could be in danger.

The bond markets are currently factoring in further rate cuts by the RBI in its December 2019 policy review. The high surplus system liquidity of around Rs 2 trillion is keeping yields steady. The market is yet to factor in the excess government borrowing that has to happen if the fiscal gap is to be bridged.

Given the high surplus liquidity, RBI will not come in to support the borrowing through OMOs and it remains to be seen if the market is willing to absorb the higher borrowing at current levels of yields.

The benchmark 10-year bond, the 6.45% 2029 bond, saw yields come down by 2 bps to 6.50% on a weekly basis. The benchmark 5-year bond, the 6.18% 2024 bond, yield came down by 5 bps to 6.17% and the 6.68% 2031 bond yield declined by 2 bps to 6.93%. The long tenure bond, the 7.63% 2059 bond, yield decreased by 4 bps at 7.19% levels.

One-year OIS yield declined by 3 bps to 5.04% while the five-year OIS yield came down by 9 bps to 5.06%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) was in surplus of Rs 1968.62 billion as of 22nd November 2019. Liquidity was in a surplus of Rs 2730.28 billion as of 15th November 2019.

Weekly G-sec Curve Spread Analysis

o The yield curve steepened at shorter end and remained steady at the longer end during last week (Table 1)

o Off the run bond curve steepened at the shorter end and flattened at the longer end as compared to the previous week.

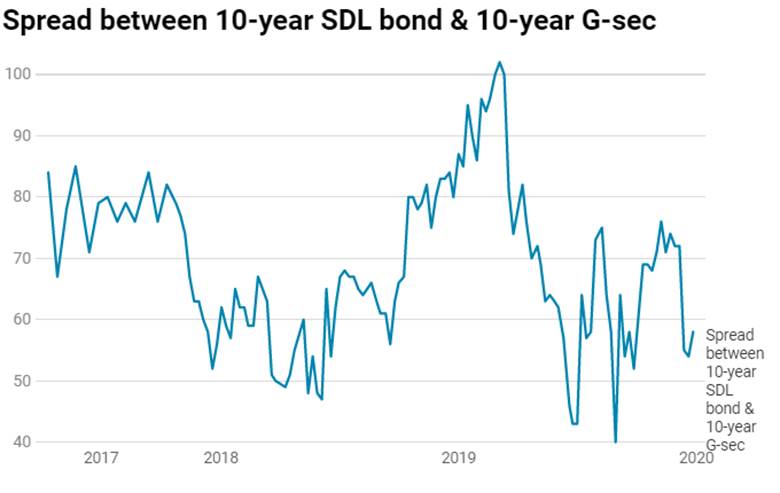

o On 19th November, the SDL spread with 10-year G-sec stood at 74 bps, 8 states borrowed Rs 86.95 billion through SDL auction. On 11th November, the spread between SDL with 10-year G-sec stood at 71 bps.