Government bond yields rose on the back of worries of the government exceeding its fiscal deficit targets in its interim budget to be presented on the 1st of February 2019. Normally, the budget on election year is a vote on account to allow the government to function until the new government presents the full budget post elections in May. However, this year the government may present a budget that is much more than a vote on account.

The government bond market has had a good run over the last few months with 10 year government bond yields dropping around 75bps from highs. Reasons for the drop include RBI OMO bond purchases, falling inflation, falling crude oil prices and Fed hinting at slowdown in rate hikes in 2019. The cut off on the new 10 year government bond issued last week came in at 7.26% levels, down over 75bps from highs seen in 2018.

The bond market at this juncture is turning cautious. The government could present a spend for elections budget that would take up fiscal deficit higher than targeted levels of 3% for fiscal 2019-20. Higher borrowing is always a worry for bond markets as demand may not match up to supply.

RBI, a heavy buyer of bonds in this fiscal year may not step in to buy bonds at the same pace next fiscal year. The supply-demand mismatch will push up bond yields if the budget shows larger than expected borrowing.

Economic data is largely supportive for bonds with lower inflation and signs of weakening economic growth. Globally too, economies are showing weakness and central banks from the Fed are turning cautious. Read our economic data analysis- January 2019 for details.

RBI is likely to keep rates steady and change policy stance from calibrated tightening to neutral or even accommodative in its policy review in February 2019. This should keep bond yields from rising too fast.

The 10-year benchmark government bond, the 7.26% 2029 bond, saw yields close 5 bps up at 7.31% on weekly basis. The benchmark 5-year bond, the 7.37% 2023 bond saw yields close 5 bps up at 7.31% and the 6.68% 2031 bond yields close 10 bps up at 7.72%. The long bond, the 7.06% 2046 bond yields close 8 bps up at 7.71% on weekly basis. Government bond yields are likely to rise further as market turns cautious into the budget.

OIS market saw one year yield remain unchanged and five year OIS yield rise by 8 bps last week. One year OIS yield closed at 6.54% while five year OIS yield closed at 6.74%. OIS yield curve will steepen on rising government bond yields.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in deficit of Rs 642 billion as of 18th January 2019. Liquidity was in a surplus of Rs 97 billion as of 11th January 2019. Liquidity fell on the back of INR weakness that saw the currency depreciate against the USD last week, FIIs sold bonds on INR fall. Read our currency market analysis for details.

Mutual Funds Sell G-secs and buy CDs

In the month of December, Mutual Funds exposure to government securities fell 11.26% to Rs 656 billion while exposure to Bank certificate of deposits rose 13.64% to Rs 1385 billion.

· As on 17th January, FII debt utilisation status stood at 57.48% of total limits, 28 bps lower against the previous week. FII investment position was at Rs 4102 billion in INR debt.FII investment position stands at Rs 2068 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2034 billion in corporate bonds.

· For the week ended 18th January, credit spreads were mixed. Three-year AAA corporate bonds were trading at levels of 8.50%, spreads were 6 bps higher at 137 bps against the previous week.

· Five-year AAA corporate bonds were trading at levels of 8.68%. Spreads were 3 bps lower at 123 bps.

· Ten-year AAA corporate bonds were trading at levels of 8.78% with spreads 18 bps higher at 134 bps. Spreads rose as the benchmark shifted from old to new 10 year government bond.

· Three months and twelve months PSU bank CD yields were trading at 6.91% and 7.75% levels at spreads of 33 bps and 95 bps respectively against T-bill yields.

· Three months’ maturity Manufacturing and NBFC sector CPs were trading at 7.00% and 7.35% levels respectively. One-year maturity Manufacturing and NBFC sector CPs were trading at 8.47% and 8.70% levels respectively.

Weekly G-sec Curve Spread Analysis

· The yield curve steepened at the long end as the new 10-year G-sec yield rose by 6 bps while other long end bond yields rose by 7-10 bps. However, the yield curve is skewed at short end as the new 10-year G-sec yields and 5-year G-sec yield trade at the same level, while the old 10-year G-sec yield trades at higher level when compared with the new 10-year G-sec yield.

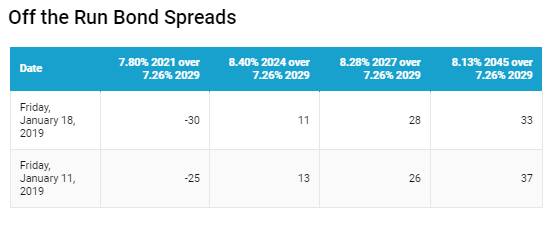

· Off the run bond spreads with the 10-year G-sec were mixed last week and off the run bond largely remain untraded.

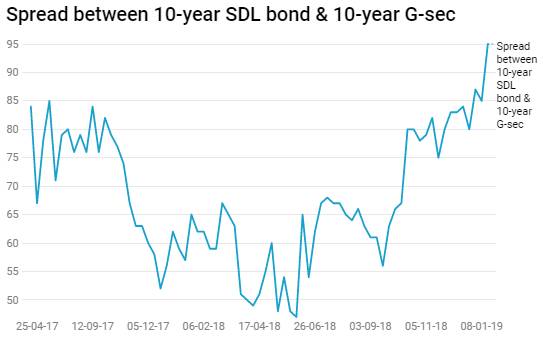

· On the 15th January 2019 auction the spread between SDLs with 10-year G-sec came in at 95 bps. On 8th January 2019 auction, the spread between SDLs with 10-year G-sec was at 85 bps. (Chart 1). Spreads rose as the benchmark changed from old 10 year G-sec to new 10 year G-sec.