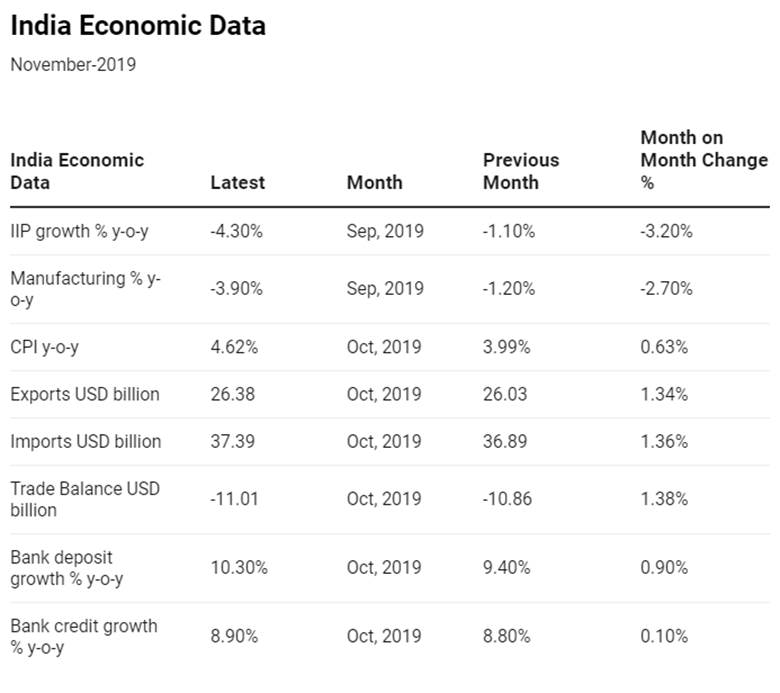

Weak economic data from IIP growth to inflation and trade is hurting sentiments on the government’s fiscal deficit. The government is likely to borrow more than budgeted to meet the rising fiscal gap that is coming about due to lower revenues on a weakening economy, big bang corporate tax rate cut and various bailout packages to floundering sectors and also bank recapitalization. The 10 year benchmark bond, the 6.45% 2029 bond, has seen yields rise by 7bps since issuance in October on government borrowing worries.

CPI inflation rate climbed to 4.62% (Y-o-Y) in October 2019, the highest in over a year, from the previous month’s 3.99% and above market expectations of 4.25%. Inflation rose above the Reserve Bank of India’s medium-term target of 4% for the first time since July 2018.

Industrial output in India dropped 4.3% (Y-o-Y) in September of 2019, following an upwardly revised 1.4% decline in August and worse than market expectations of a 2% fall.

The trade deficit in India narrowed to USD 11.01 billion in October of 2019 from an upwardly revised USD 18 billion gap a year earlier. It also came below market forecasts of USD 12.05 billion. Imports slumped 16.3% (Y-o-Y) to USD 37.39 billion. Exports declined 1.1% (Y-o-Y) to USD 26.38 billion.

The 10 year government bond yield has moved up despite rate cuts by the RBI and its continuing accommodative stance. The market is expect the RBI to cut rates in December despite higher inflation, which is largely due to rise in vegetable prices. However, the 10 year bond yield has stabilized at around 6.52% levels on the back of excess liquidity in the system.

System liquidity is at Rs 2.7 trillion largely on the back of bank deposits growing faster than credit, government spending and RBI fx purchases. FII s continue to buy Indian equities with net purchases in October and November till date ( Rs 123 billion and Rs 144 billion respectively). The high system liquidity is keeping bond yields steady despite government borrowing worries. Banks are parking most of their surpluses with the RBI at reverse repo rate of 4.90% and bond yields at around 6.5% offer better carry than the reverse repo rate.

The question is how durable is the high liquidity? Given that banks are running a huge surplus on excess deposits relative to credit and that the government is spending heavily, liquidity will stay in high surplus. The only negative factor is FIIs pulling money out in a large scale on the back of a weakening INR but FIIs have been pumping in money rather than taking money out from the markets.

High liquidity and low rates will see markets pulling down yields across the short end of the curve, both the government bond and the highest safety AAA credit curve. OIS yields too will be well supported at lower levels. The longer ends will stay steady until the government comes out with communication on borrowings.

The benchmark 10 year bond, the 6.45% 2029 bond, saw yields come down by 4 bps to 6.52% on a weekly basis. The benchmark 5-year bond, the 6.18% 2024 bond, yield came down by 2 bps to 6.22% and the 6.68% 2031 bond yield declined by 1 bps to 6.95%. The long tenure bond, the 7.63% 2059 bond, yield decreased by 4 bps at 7.19% levels.

One-year OIS yield declined by 7 bps to 5.07% while five-year OIS yield came down by 12 bps to 5.15%.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) was in surplus of Rs 2765.67 billion as of 15th November 2019. Liquidity was in a surplus of Rs 2535.09 billion as of 8th November 2019.

Weekly G-sec Curve Spread Analysis

· The yield curve flattened marginally at shorter end and steepened slightly at the longer end during last week (Table 1)

· Off the run bond spreads movement remained steady as compared to previous week.

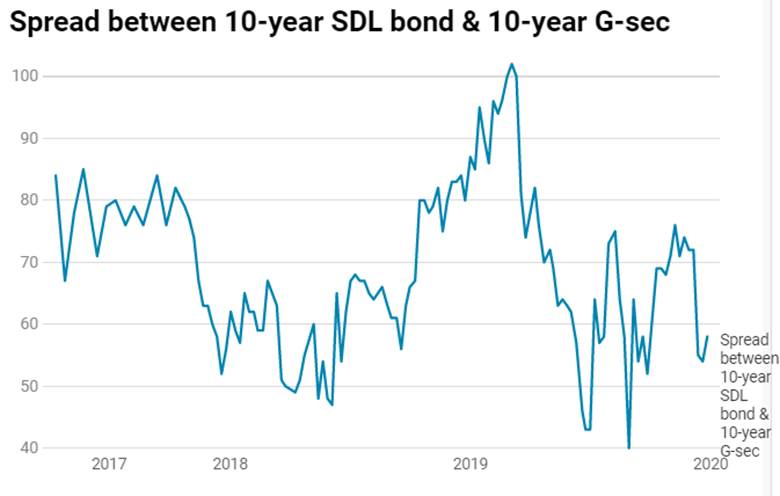

· On 11th November, the spread SDL with 10-year G-sec stood at 71 bps, States borrowed Rs 137.50 billion through SDL auction. On 29th October, the spread between SDL with 10-year G-sec stood at 76 bps.